EMPEA Summit in Review: Sustainable Investing in Emerging Markets 2019

Limited Partners-Only Breakfast

Development finance institutions and institutional investors began their morning with the Limited Partners-Only Breakfast. Chaired by UNPRI’s Natasha Buckley and FMO’s Walter van Helvoirt, the roundtable addressed how asset owners are managing ESG and impact considerations across their portfolios. Participants elaborated on how they evaluate GP alignment with their own ESG and impact objectives, as well as how their priorities, evaluation processes, and management systems have evolved.

Keynote Interview

The main Summit program kicked off with the Financial Times’ Henny Sender’s interview of Steve Pagliuca, Co-Chairman of Bain Capital. Pagliuca described how his career has continued to reinforce his belief that investors can not only make good investments but investments that help people. He observed the enormous impact that venture capital has had on supporting disruptive medical startups and the range of opportunities for biotechnology innovation across geographies that would contribute to the global good. He noted that while there are some markets that can expect to have lower returns at this stage of development, in others, there is no trade-off between investment returns and a sound ESG policy.

PE Leaders Panel: Delivering the SDGs AND Generating Above Market Returns — Case Studies on Progress

In the PE Leaders Panel, panelists discussed how their firms have aligned their investment strategies to the SDGs and how they target rigorous commercial returns while tying their investment strategies to creating impact from the outset. Panelists then discussed what they observe in their respective regions of investment: Runa Alam of DPI and Tarun Mehta of Aavishkaar Group described the shift in LP sentiment and private capital ecosystems in Africa and India, and John Morris of 17 Asset Management explained the opportunities he sees in Jordan, particularly in women-led businesses. Alam elaborated that while 20 years ago, only DFIs wanted to invest in Africa and ESG was heavily associated with NGOs, the landscape has shifted dramatically: commercial LPs are now interested in opportunities in Africa and asking for ESG reporting, and ESG requirements across her investor base are getting more rigorous. In offering final advice to the audience, panelists stressed the importance of maintaining strong teams and backing driven entrepreneurs.

Navigating Impact Measurement – How Can Investors Compete on Impact vs. Impact Measurement

In their discussion, IFC’s Neil Gregory and IMP’s Clara Barby honed in on the issue of impact measurement. The Operating Principles for Impact Investing developed by IFC and the Impact Measurement Project were created to allow LPs and GPs alike to move beyond current debates on impact measurement and compete on what really matters: the impact performance of their investments. Barby explained that a range of resources serving different functions exist for impact management, similar to the variety of financial tools and metrics, and the goal of IMP is to create a common narrative on how these tools fit together by 2021. Gregory noted that the goal of the Principles, whose signatories currently represent an estimated one-third of the total impact investing market, is to provide transparency and credibility to the space through GP and LP public disclosure and independent verification requirements.

How Can A Higher-Risk Investment Approach Unlock Markets to Advance Development Impact?

Lynn Nguyen of OPIC, Sean Hinton of Soros Economic Development Fund, and Yasemin Saltuk Lamy of CDC discussed how each of their institutions are working to de-risk private capital investment in emerging markets. Lamy discussed CDC’s mission to shape nascent markets in frontier and emerging economies, the different types of risk present in these markets, and how CDC measures and addresses these risks. Commenting on OPIC’s integration into the DFC, Nguyen explained how the new institutional mandate is allowing the DFI to creatively structure deals to gain wider risk exposure and create maximum development impact. She emphasized that sound financial decision-making when making commitments is key to driving commercial capital into these markets. Hinton noted that business-as-usual investing discounts future generations, imploring the financial system to relax these temporal assumptions in order to arrive at the essential truth: a sustainable world is necessary for sustainable businesses.

Does the Structure Fit the Purpose?

CDC’s Mark Kenderdine-Davies, the Chair of EMPEA’s Legal & Regulatory Council, led experienced industry practitioners in a discussion of how fund vehicles can be structured in order to maximize GP and LP alignment and drive maximum impact, with a focus on the specific sectors, strategies, and regions that warrant alternative structures. AfricInvest’s Ann Wyman discussed the impetus behind the firm’s formation of its financials-focused FIVE evergreen platform, namely the particular regulatory constraints and impact concerns of Africa’s financial services sector. Stephen Lee of TIAA-Nuveen noted that different types of LPs have appetite for these types of structures, with impact-focused investors more likely to be interested in non-traditional funds. Wyman echoed this sentiment, explaining that evergreen vehicles such as FIVE take longer to gain the critical mass necessary to attract big-ticket institutional investors. The panelists agreed that with regards to all fund terms, alignment of LP and GP priorities is key. Debevoise & Plimpton’s Geoffrey Kittredge elaborated on the various ways this alignment is structured in LPAs, including upside and downside incentives, and how these can be altered to align for non-financial returns such as impact goals.

Keynote Interview

In an interview with LeapFrog Investments’ Karima Ola, Dr. Rajiv Shah, President of the Rockefeller Foundation, explained how his experiences in public-sector and non-profit organizations helped to form his belief in the power of public and private sector partnerships to achieve both financial returns and impact. He discussed the ways Rockefeller has restructured in order to make itself a risk capital partner to commercial investors in order to attract capital to impactful sectors and underserved regions. While he sees the proliferation of sustainable approaches to investing as ultimately positive, it is important to distinguish firms that are truly mission-driven from their counterparts that are simply crowding into the space. Therefore, he encouraged fund managers and institutional investors to hold themselves to a high standard of impact.

Panel Discussion: LP Panel – How to Assess GPs and Your Own Contribution to the SDGs?

In their discussion with UNPRI’s Natasha Buckley, panelists explained the ways they assess the impact of their portfolios. While some panelists have used the SDGs to communicate with stakeholders and set sector priorities, others have found other impact frameworks not necessarily tied to the SDGs. The panelists then discussed the opportunities in the impact investing space. Anna Snider of Merrill Lynch and Vikram Raju of Morgan Stanley reported that there are plenty of investible markets with the potential to garner commercial returns and impact, with Raju noting that there is still a need for philanthropic capital and blended finance to develop some less mature ecosystems. Rodriguo Louro of TURIM explained that the impact investing market is still somewhat shallow in Brazil; however, by investing in impact-focused fund managers outside of the country, his firm aims to educate clients on the space and increase demand for Brazilian impact-focused GPs.

Concurrent Session: Driving Responsible Exits

Participants in the exits panel discussed how investors safeguard the impact of their investments after selling their positions, all noting that investors must consider responsible exits beginning in the pre-investment phase. While some panelists argued that the only way to ensure impact after exit is to invest in products and services that are intrinsically impactful, others emphasized the importance of exiting to like-minded financial investors. Laurie Spengler of Enclude Capital explained that when exiting a portfolio company, GPs must be selective with whom is invited to bid, clarify and align interests amongst the company’s other shareholders, and be upfront in the non-financial criteria used to evaluate bids. Other panelists offered examples of self-liquidating financial instruments, such as founder buyback and employee shareholding agreements, that ensured sustained impacts beyond the life of the investments.

Concurrent Session: Private Credit as an Impact Lever

Private credit fund managers and allocators shared their diverse experiences with driving behavioral change in portfolio companies as debt investors, with some finding it difficult as non-equity shareholders and others commenting on the value of incremental investment across the capital structure to spur change. TriLinc’s Gloria Nelund stressed the high potential development impact of private credit: with private equity, an exit results in capital flow from emerging to developed economies; whereas with private debt, all equity remains in the hands of local communities that will put that capital back into their own economies. Panelists discussed the ways that private credit can create impact in economies such as Africa with low bank lending capacity; in contrast, Rob Petty of Clearwater/Fiera noted that there is growing competition from banks in parts of Asia but there are opportunities in more niche and creative strategies and markets. The panelists agreed that emerging markets are still severely underpenetrated by private credit and there is a wealth of opportunities for investors in the asset class.

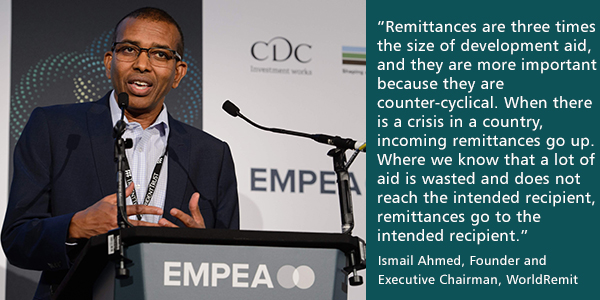

Lightning Talk: Harnessing the Digital Revolution and Financial Innovation To Sustainable Impact

In his keynote address, Ismail Ahmed described the difficulties associated with sending remittances home as a migrant from Somalia studying and working multiple jobs in the United Kingdom, an experience which led to his founding of WorldRemit, a mobile international remittances platform. He noted that the value of global remittances represent three times the volume of development aid, a large share of which never reaches its intended recipients. Making remittances easy, affordable, and accessible is therefore enormously impactful for economic development. This capital has become part of the formal economy, helping recipients build businesses in developing countries. The digitization of the financial system, he argued, also helps fight financial crime.

Deep Dive Case Study Roundtables I and II

Summit attendees then broke out into two sets of concurrent roundtables. Held under Chatham House Rule, these small group discussions allowed attendees to discuss particular topics in detail and share experiences. Please find the six roundtables below.

Renewable/Alternative Energy and Climate Change (Goals 6, 7 & 13)

In the roundtable on Renewable/Alternative Energy & Climate Change, facilitators Gunter Fischer of GEEREF and Jake Cusack of CrossBoundary asked participants to share the specific types of renewable energy in which they saw the most activity and promise. Participants shared observations on the differing profit and risk profiles of on-shore and off-shore wind, hydro, geothermal, and solar power, as well as opportunities in new technologies in the sector.

Health Care (Goal 3)

Geoffrey Burgess of Debevoise & Plimpton led a discussion of the diverging opportunities for health care investment in emerging markets and measuring the impact of such deals. Opportunities in the sector have differed regionally based on local conditions such as the state of medical systems, internet accessibility, population demographics, doctors’ training and expertise, and legal regulations. Given the wide range of services provided by health care portfolio companies, it can be difficult for fund managers to quantify the impact of their investments. LPs also chimed into the conversation, highlighting that although they have witnessed innovations improving the quality of life for chronically ill persons, there are still basic health care needs not being met in many emerging countries.

Business Model Innovations for Reaching Frontier Markets

Discussion leaders John Maris of DAI, Vanessa Holcomb Mann of USAID Invest, James Doree of Lion’s Head, and St. John James Bungey of Broadreach Advisory & Capital led roundtable participants in a discussion of the constraints facing SMEs in frontier economies. Access to working capital is an impediment to growth for many small businesses in less-mature markets, but the traditional private fund management model may not be well-suited to the small-cap deal segment. More creative solutions, such as permanent capital or platform models, as well as creative corporate partnerships such as those pursued by USAID Invest, are need to get more capital into the hands of entrepreneurs in frontier regions.

Gender Parity: From Insights to Action (Goal 5)

IFC’s Heather Mae Kipnis presented on IFC’s landmark report Moving Towards Gender Balance in Private Equity & Venture Capital, which showed that private capital funds with gender-balanced investment teams had up to 20 percent higher returns than male- or female-biased teams. She also presented additional EMPEA analysis of the demographic data, including granular regional breakdowns of gender representation. The facilitators discussed their respective initiatives regarding gender representation in their firms and gender lens investing. Participants discussed various tactics firms use to improve the recruitment, retention, and support of women within the EM private capital space.

Food Production & Agriculture (Goal 2)

The food and agriculture roundtable led by Wise Chigudu of SilverStreet Capital discussed how EM-based companies focused on food production, logistics, and delivery can effectively reduce hunger. Specifically, fund managers stressed the importance of identifying local communities and farmers with which to partner, as well as a logistics and distribution plan for the commodities. When measuring farm productivity, several participants warned peers to avoid chasing yield alone: without flexible policies that can adapt to a shifting agricultural sector, as well as suitable storage and distribution channels, emphasizing yield can lead to a surplus of produce that eventually spoils. An organized logistics and distribution process can prevent gluts; however, attention must be paid to crop collection, climate-controlled storage, automobile reliability, and delivery timeliness.

Infrastructure (Goal 9)

Tania Swanepoel of African Infrastructure Investment Managers (AIIM) and Carole Welton Kaagaard of A.P. Moller Capital led a discussion of key sustainability and risk management considerations for infrastructure investors in emerging markets, particularly in Africa. The physical risks posed by climate change was top of mind for many participants. Meanwhile, political risk, as well as insurance products or other means of addressing it, was also a prime consideration. Finally, participants discussed the nuances of how infrastructure is developed in partnership with public bodies in African markets. Both competitive tenders and bilateral deals will have a role to play in building a more sustainable future.

Plenary Panel Discussion: Creating Sustainable Finance Partnerships: Opportunities, Challenges, and Lessons Learned

Panelists explored how a diverse array of stakeholders have collaborated to implement blended finance models in the health care sector. All agreed that coalitions between a diverse range of actors, including private investors and companies, non-profit organizations, and governments, is necessary to drive growth in business verticals and markets that have enormous development potential, but lack the maturity to be financially viable for private investors alone. Notably, Claudio Lilienfeld of Gilead Sciences described the company’s work on developing and providing treatment for HIV, hepatitis, and other diseases, and its partnership with USAID in catalyzing innovative approaches to improve access to primary healthcare in low resource settings. He explained that companies must leverage the donor community’s desire to catalyze private sector involvement in order to reach the bottom of the pyramid and make their operations scalable.

Views from the Field: An Update from EMPEA’s ESG Member Community

Hany Asaad, Co-Founder of Avanz Capital and Chair of EMPEA’s ESG Member Community, updated conference attendees on the completed and in-development deliverables of the community’s four working groups. These active member groups focus on the UN Sustainable Development Goals, Governance, Gender Parity Acceleration, and ESG Reporting & Transparency, aiming to create practical guidance for EM private capital fund managers, institutional investors, and related stakeholders on matters related to ESG.

Keynote Conversation: Looking Towards 2030: The Future of ESG and Impact Investing

In the closing session of the day, Matt Christensen of AXA Investment Managers and Elizabeth Littlefield of Albright Stonebridge Group speculated on the future of ESG and impact investing. Throughout the session, Christensen and Littlefield polled the audience on their expectations for 2030 on topics such as consolidated ESG rating agencies, the proliferation of impact across the EM investment landscape, pension asset allocation, and strategies to increase impact. Looking forward, they agreed that the industry has evolved but still has far to go. While Christensen commented on the enormous transformation in thinking about ESG over the past ten years, Littlefield countered that the proliferation of ESG considerations has largely occurred in select pockets, stressing the importance of bringing in EM corporates and other investors to truly make ESG mainstream across regions. Christensen contended that it is unclear where the most significant influences on ESG in emerging markets will come from over the next decade, but he is confident that an increased push towards sustainability is imminent.

Sustainability & Operational Excellence Challenge

To close the day, the three finalists of the Sustainability & Operational Excellence Challenge presented their case studies to the audience: Zachary Fond of Alta Semper and HealthPlus CEO & Founder Bukky George presented on Alta Semper’s investment in HealthPlus, a Nigeria-based retail pharmacy chain; Shami Nissan discussed Actis’ formation of Ostro Energy, an India-based renewable energy platform; and Flavio Zaclis spoke on Barn Investments’ investment in Brazil-based agricultural technology company Strider. Summit attendees voted on the firm that they believed best exemplified outstanding sustainable impact from an operational and ESG perspective, selecting Barn Investments as the winner. UNPRI’s Natasha Buckley, one of the challenge’s three judges, presented the award to Zaclis.

Enjoy the EMPEA 15th Anniversary Video: