Bright Spots in Global VC

Global Tech Brief

Talking Shop

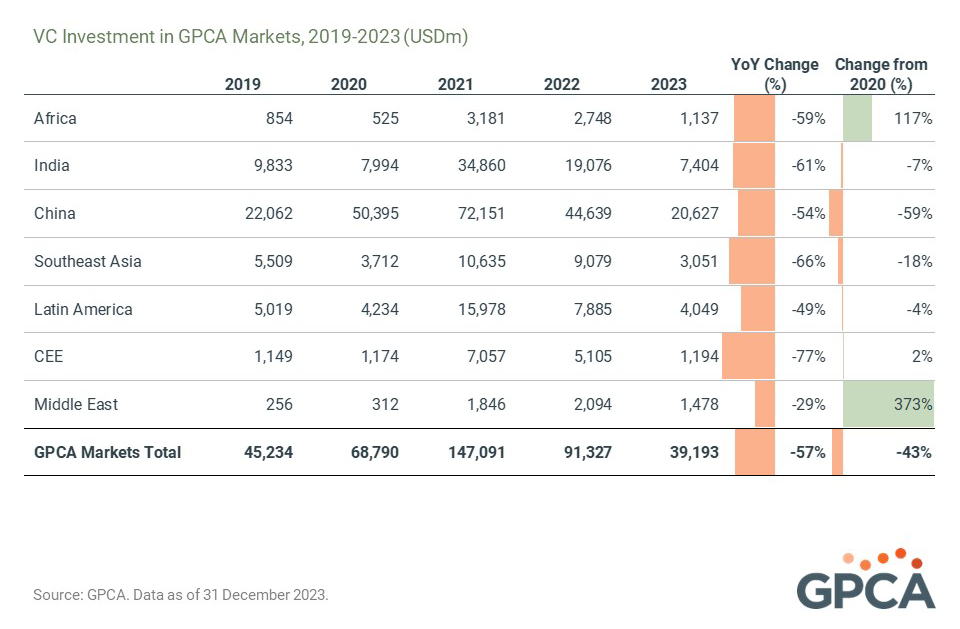

VC dealmaking continues its global reset. Startups in GPCA markets raised USD39.2b of venture capital funding across 3,625 transactions in 2023, a 57% dollar pullback from 2022.

Despite the decline, we found bright spots of growth compared to pre-pandemic levels. Notably, the resilience of Africa’s VC and the Middle East’s burgeoning tech ecosystem experienced growth rates of 117% and 373% compared to 2020.

New players also stepped up as additional capital providers within our ecosystems. While there are fewer new faces in late-stage deals, smaller operator-led firms have become commonplace in early-stage rounds. Micro-VCs – funds with USD30m in AUM or less – play a crucial role in supporting the new wave of startups coming out of our markets, particularly in India. VCs like Blume Ventures have experienced the advantages of co-investing with micro-VCs firsthand. Beyond providing top-of-funnel deal-flow opportunities, Blume sees these micro-VCs as specialist investors who bring sector-focused expertise to the table, often being former operators or active angels. Blume estimates there are more than 100 micro-VCs in India alone.

It is still too early to tell which ones will evolve into established firms. In the words of Blume’s Sarita Raichura, “I’m not sure how many of these will stand the test of time.”

Stay tuned for our annual VC/Tech report, with additional details on emerging trends, sector bright spots and crossborder insights.

The Big Tickets

- AI | Alibaba Group and HongShan (fka Sequoia China) led a ~USD1b round for Moonshot AI, a China-based AI startup building LLMs capable of long text and data inputs, with participation from Meituan and Xiaohongshu. The round reportedly values the company at more than USD2.3b a year after its founding.

- Moonshot AI was founded by Yang Zhilin.

- AEROSPACE | Orienspace, a China-based private rocket developer, raised a ~USD84m Series B from Broad Vision Funds, Shenyin & Wanguo Investment, Hongtai Capital Holdings, Xin Ding Capital, and follow-on from CMBC Capital Holdings, Hike Capital and Pagoda Investment.

- Orienspace raised a ~USD60m Series A in 2022.

- SEMICONDUCTOR | CICC Capital and Haiton New Energy Private Equity led a ~USD70m Series D for Advanced Materials Technology & Engineering, a China-based producer of semiconductor front-end processing equipment, with participation from Hongtai Aplus, Qianxi Capital, Svolt Capital and others.

- AI | Matrix Partners India led a USD50m Series A for Krutrim, an India-based silicon chip and cloud infrastructure startup. The startup is valued at USD1b.

- Krutrim was founded by the CEO of Ola Electric, Bhavish Aggarwal.

- WOMEN-LED | General Atlantic led a USD50m Series C for Bold, a Colombia-based payment platform for SMEs, with participation from IFC and follow-on from InQLab and Amador.

- Bold previously raised a USD55m Series B from General Atlantic, Endeavor Catalyst, InQlab, Amador Holdings, Tiger Global and others in February 2022.

- Bold was co-founded by Ana María Sandoval, Enríque Ramírez, Jorge Ulloa, José Fernando Velez and Sergio Vergara.

- EV | Yamaha Motor led a USD40m Series B for River, an India-based electric scooter manufacturer, with follow-on from LowerCarbon Capital, Toyota Ventures, Al-Futtaim Group and Maniv Mobility.

- AGTECH | Syngenta Ventures, the CVC arm of global pesticide manufacturer Syngenta, led a USD38m Series D for ProducePay, a US-based financing platform for farmers in Latin America, with participation from CF Private Equity and follow-on from G2 Venture Partners, Anterra Capital, Astanor Ventures, Endeavor8 and others.

- G2 Venture Partners led a USD43m Series C in June 2021.

- HEALTHTECH | Amigo Tech, a Brazil-based digital accounting and backend management platform for clinics, raised a ~USD33m round from Riverwood Capital.

- DIGITAL SECURITY | Bessemer Venture Partners led a ~USD31m Series B for Incognia, a Brazil-based geolocation data platform for credit origination, with participation from FJ Labs and follow-on from Point72 Ventures, Prosus Ventures, Valor Capital Group and Unbox Capital.

- Incognia raised a USD15.5m Series A from Endeavor Catalyst, Point72 Ventures, Prosus Ventures, Unbox Capital and Valor Capital Group in June 2022.

Deals

- EV | BluSmart Mobility, an India-based all-electric ride-sharing service, raised USD25m from responsAbility.

- BluSmart Mobility previously raised a USD24m round in December 2023.

- LEGALTECH | Federated Hermes Private Equity led a USD25m round for Xcelerate, a Singapore-based GRC and ESG platform, with follow-on Altair Capital and Mizuho Asia Partners.

- EV | Equator led a USD24m Series A for Roam, a Kenya-based provider of low-cost and low-emission transport solutions in Africa, with participation from At One Ventures, TES Ventures, Renew Capital, The World We Want and One Small Planet.

- DEBT | DFC committed up to USD10m in debt financing for the round.

- BIOTECH | Celadon Partners led a USD21m Series A for Genetic Design and Manufacturing Corporation, a Singapore-based biotech focused on advanced genetic therapies, with participation from WI Harper Group, SEEDS Capital and NSG Ventures.

- AI | Mosaic Ventures led a USD13.5m Series A for Podcastle, an Armenia-based podcasting platform specializing in generative AI-driven features, with participation from Anthony Casalena (Squarespace) and René Rechtman (Moonbug Media), as well as follow-on from RTP Global, Point Nine Capital, Sierra Ventures and AI Fund.

- Podcastle previously raised USD7m from AI Fund, Point Nine Capital, RTP Global, S16VC, Sierra Ventures in October 2021.

- BIOTECH | Phagelab, a Chile-based biotech company developing bacteriophage-based applications for the livestock industry, raised a USD11m round from NAZCA, Collaborative Fund, Water Lemon Ventures and Kevin Efrusy (Accel).

- TRAVELTECH | Taiwania Capital led a USD10m Series B for Daytrip, a Czech Republic-based platform for traveling with local drivers, with follow-on from Euroventures, J&T Ventures and N1.

- HEALTHTECH | Yodawy, an Egypt-based online pharmacy marketplace and insurance benefits platform, raised a USD10m round from Ezdehar Management.

- FOODTECH | Invenio Partners led a ~USD8.7m Series A for Nasekomo, a Bulgaria-based producer of animal feed from organic waste using bio-converting insects.

- AI | Shorooq Partners, Algebra Ventures and Dubai Future District Fund led a USD4m Series A for DXwand, an Egypt-based AI software to automate call centers.

- AI | Courtside Ventures led a USD4m seed round for Camb.ai, a UAE-based generative AI content localization platform for media companies and content creators, with participation from TRTL Ventures, Blue Star Innovation Partners, Ikemori Ventures and Eisaburo Maeda.

- AGTECH | Shamba Pride, a Kenya-based last mile online-to-offline marketplace connecting small farmers to input manufacturers, raised a USD3.7m debt-equity pre-Series A from EDFI AgriFI with follow-on from Seedstars Africa.

- CLIMATETECH | Thryve.Earth, a Singapore-based cloud platform that develops and manages climate solution projects, raised a USD2.6m seed round from Openspace Ventures and Capital Code.

- GAMES | Laton Ventures and 500 Global’s Emerging Europe led a USD2.25m seed round for Pine Games, a Turkey-based mobile gaming startup, with participation from angel Mert Gur (Loop Games).

- Alaya Capital and Switch VC led a USD2.2m seed round for Coba, a Mexico-based cross-border financial services provider.

- FOODTECH | Forge Ventures led a USD2m seed round for Prefer, a Singapore-based bean-free coffee startup, with participation from 500 Global, A*ccelerate, Better Bite Ventures, Sopoong Ventures, SEEDS Capital, Entrepreneur First and Pickup Coffee.

- Prefer developed a system to manufacture coffee products without coffee beans, leveraging the fermentation of surplus bread, soy pulp and spent grain.

- WOMEN-LED | Northstar Group and Ansible Ventures led a USD1.3m seed round for NativeX, a Vietnam-based online English learning platform for local working professionals.

- NativeX was co-founded by Ai Chau and Phat Nguyen Dinh.

- LOGISTICS | Nama Ventures led an undisclosed seed round for Cargoz, a UAE-based warehousing and logistics startup, with participation from Innovest Properties and follow-on from Raz Holding Group. The new funding will be used to launch Cargoz operations in Saudi Arabia.

- Golden Gate Ventures led a seed round for Arkadiah, a Singapore-based climate tech solutions provider for nature restoration projects, with participation from The Radical Fund and Money Forward Venture Partners.

- PROPTECH | Silkhaus, a UAE-based short-term property rental platform, secured pre-Series A financing from Partners for Growth.

- Partners for Growth’s other investments in the Middle East include Tabby and TruKKer.

- Silkhaus previously raised a USD7.8m seed round from GFC, Nordstar, Nuwa Capital, VentureSouq, Whiteboard Capital and Yuj Ventures in November 2022.

- WOMEN-LED | Bancolombia led a seed round for Quipu, a Colombia-based lending platform for SMEs, with participation from IDB Lab, Caffeinated Capital, Flori Ventures and Vertical Partners, and follow-on from G2 Momentum Capital. The startup has raised USD3.5m between its pre-seed and seed rounds.

- Quipu was co-founded by Mercedes Bidart, Viviana Siless and Juan Constain.

- FINTECH | Doxa Holdings, a Singapore-based digital procurement and supply chain financing platform, raised an undisclosed round from Cento Ventures.

- Doxa Holdings previously raised a USD2.1m pre-Series A in January 2022.

For more Latin American deal activity, subscribe to LAVCA’s LatAm Venture Bulletin.

Funds

- HighLight Capital reached a USD550m final close for its fourth USD-denominated venture fund, investing in China’s healthcare, biotech and consumer sectors.

- NIO Capital reached a CNY3b (~USD417m) final close for its second RMB-denominated fund. The vehicle will focus on mobility & logistics, new energy and frontier technology sectors in China.

- NIO Capital’s latest investments include SICHAIN, Tianhai Auto Electronics and PCG Power.

- Partech Partners reached a ~USD300m final close for its second Africa fund. The vehicle will support seed to Series C rounds for startups focused on education, mobility, finance, healthcare, delivery and energy across the region.

- LPs include Africa Re, Dubai Future District Fund, AXIAN Investment and the African Development Bank.

- Partech opened an office in Lagos led by Tito Cookey-Gam.

- Huimei Capital raised CNY1.5b (~USD211m) for its latest RMB-denominated fund, backing early-stage healthtech startups in China.

- Huimei Capital’s latest investments include Sensview, Zelixir Biotech and BioEngine.

- Seviora Capital and Temasek launched The Future of Food and Farming fund, focusing on late-stage venture and early-growth agri-food companies across the Asia-Pacific region. The fund has raised USD173m from Seviora, Temasek and Norinchukin Bank.

- 3TS Capital Partners reached a EUR111m (~USD120m) final close for its fourth flagship fund focused on rapidly growing technologies companies in Central & Eastern Europe.

- LPs in TCEE Fund IV include EIF, Tesi, SZTA and Erste Asset Management.

- Orient Growth Ventures reached a USD90m final close for its second fund-of-funds strategy in Southeast Asia and India.

- Orient Growth reached a USD25m final close for Fund I in 2020.

- Investors backed by Orient Growth include Blume Ventures, AC Ventures, Foxmont Capital and Jungle Ventures.

- Practica Capital reached a EUR80m (~USD87m) final close for its third fund to invest in seed-stage startups in the Baltics.

- COTU Ventures reached a USD54m final close for its debut fund to invest in pre-seed and seed-stage startups in the GCC.

- COTU Ventures was co-founded by former BECO Capital Managing Partner Amir Farha.

- Smok Ventures reached a USD25m final close for its second fund to invest in seed-stage SaaS, AI and gaming startups across Central & Eastern Europe.

- Sunicon Ventures reached a USD10m final close for its debut fund to invest in seed and early-stage startups in India.

- GrowthCap Ventures reached a INR200m (~USD2.4m) first close for its debut fund, focusing on early-stage fintech, deeptech and SaaS startups in India.

IPOs, M&As and Exits

- Temasek fully exited its 5.4% stake in PolicyBazaar, an India-based insurance aggregator, through an open market sale for INR24.25b (~USD300m).

- SoftBank has sold over 4% of its stake in India-based payments app Paytm in 2024.

- Advent International exited Sophos Solutions, a Colombia-based digital banking platform, through a sale to GFT Technologies, a multinational developer of IT solutions for digital transformation in the finance, insurance and manufacturing industries.

- Accel-KKR and MidEuropa exited Softeh Plus, a Romania-based ERP platform, through a sale to Symfonia, a Poland-based ERP and HCM software solutions provider for SMEs.

News

- Qatar Investment Authority launched a USD1b fund of funds strategy to invest in international and regional managers supporting fintech, edtech and healthtech startups operating in the GCC.

- EDTECH | The saga for India-based Byju’s has evolved since our last edition:

- Alpha, Byju’s US arm filed for bankruptcy after defaulting on a USD1.2b debt obligation to creditors

- Byju’s board held an emergency meeting to unanimously remove the company founder and CEO, driven by interest from General Atlantic, Prosus Ventures, Peak XV Partners and Chan Zuckerberg to restructure the company’s governance.

- CEO Byju Raveendran says rumors of his ousting have been “greatly exaggerated” and that he is still CEO.

- To be continued…

- BATTERIES | India-based Tata Group is considering a spinoff of Agratas Energy Storage Solutions, its battery manufacturing business, to be listed in the public markets at a reported USD5-10b valuation.

- Tata is also considering a spinoff strategy for its EV business in the next 18 months.

- CONTEXT | Producers of lithium and nickel are also pausing projects after prices collapsed, and momentum slows for electric-vehicle sales

- BIOTECH | The US Congress had introduced a bill to restrict Chinese biotech companies from accessing genetic information on US residents and for foreign adversary biotech companies from doing business with federally funded medical providers.

- The bill is currently focused on the operations of both China-based BGI Group and WuXi, but lawmakers have signaled regulatory implications could have a broader industry impact.

- Fortune: U.S. lawmakers are trying to bar Chinese biotech companies over fears about America’s failure to compete with China in the industry.

- CROSSBORDER | Saudi Arabia is mandating that Chinese tech companies invest locally in return for landmark deals.

“They want your company and engineers to train their own talent. It comes with strings attached. Chinese companies are usually more open to intellectual property transfer than European and US companies, which have very strict policies on this.”

- Saudi Arabia–based tech companies raised more capital than their UAE counterparts for the first time, per Bloomberg.

- Stay tuned for GPCA’s 2024 Trends in Global Tech report.

- CROSSBORDER | Gogoro, a NASDAQ-listed and Taiwan-based EV and battery manufacturer, partnered with Chilean energy company Copec to launch operations in Chile and Colombia.

- DRY POWDER | Bloomberg: Cash-Rich Venture Capital Firms Eye New Investments in Latin American Startups

“Venture investors sitting on nearly USD4b are turning aggressive after a dire year for Latin America’s startups.”

Investors

- SoftBank is taking its time on new investments.

- While SoftBank continues to look for new opportunities through Vision Fund II and supporting its Vision Fund I, the team has become much more sensitive around deployment and valuations, per Bloomberg.

“SoftBank is currently focused on managing its existing portfolio and hemming in losses. While Vision Fund II invested more than USD40b in startups during the 2021 fiscal year, it invested USD3.8b in 2023 – and only USD90m in the most recent quarter.”

- While SoftBank continues to look for new opportunities through Vision Fund II and supporting its Vision Fund I, the team has become much more sensitive around deployment and valuations, per Bloomberg.

- Forbes examined the trajectory of Noor Sweid, Managing Partner at Global Ventures, highlighting her support for the Middle East’s VC ecosystem and the firm’s commitment to purposeful ventures.

- Thrive Capital has expanded its strategy of investing in directs to also include stakes in other VC funds, per Fortune: “As of last fall, Thrive had invested in at least 17 venture capital firms from its USD3.3b eighth growth-stage fund.”

- Thrive Capital has actively invested in Brazil and India in the past, in transactions such as Nubank, Pipo Saúde, Loft, Practo and Pitzi.

- VEF shared its conviction on Gringo, a Brazilian car documentation management platform, as part of its embedded finance portfolio since 2022.

- VEF led a ~USD38m Series B for Gringo in March 2022 with participation from Piton Capital, and follow-on from KASZEK, ONEVC and Global Founders Capital.

- Neil Shen of HongShan (fka Sequoia China) is officially a permanent resident of Singapore.

- HongShan launched an office in Singapore after splitting from its India- and US-based counterparts in June of last year.

People & Programs

- Quona Capital is looking for an investment partner to lead its second Opportunity Growth Fund. Interested candidates are welcome to apply.

- Integra Partners is looking for two junior investors to join its venture capital team in Indonesia and the Philippines. Interested candidates can submit a resume and cover letter to sgventures@integrapartners.co.

- MIDDLE EAST Amit Midha, former president for Asia Pacific for Dell, has been appointed as CEO of Alat, a newly-launched fund backed by USD100b in commitments from the Saudi Public Investment Fund to invest in technology, semiconductors and capital goods.

GPC Conference 2024

25-27 March 2024

New York

GPCA’s Global Private Capital Conference in partnership with IFC will convene at the Conrad New York Downtown.

Newly announced keynotes and featured sessions include:

- The Business of Sports in Africa with Masai Ujiri (Toronto Raptors) and Tope Lawani (Helios Investment Partners)

- The Global Outlook for Tech Investments with Noor Sweid (Global Ventures), Yemi Lalude (TPG), Jessica Huang Pouler (Openspace Ventures) and Mehmet Atici (Earlybird Digital East)

- Reorganizing Global Supply Chains with David Do (Vietnam Investments Group), Hakim Khelifa (AfricInvest), Kryztof Kulig (Innova), Gregorio Schneider (TC Latin America Partners) and Scott Voss (HarbourVest Partners)

- The Future of Health: Innovation & Healthtech with Ola Brown (Healthcap Africa), Selin Kurnaz (Massive Bio), Kup-Yi Lim (Monk’s Hill Ventures) and Monique Mrazek (IFC)

- LP Perspectives on Private Markets with Leo Chenette (NYSCRF), Mateo Goldman (US DFC), Craig Thorburn (Future Fund) and Jose Sosa del Valle (Lexington Partners)