GPCA’s 2024 Industry Data & Analysis features in-depth private capital data, commentary and analysis on key trends across global markets.

Key data takeaways:

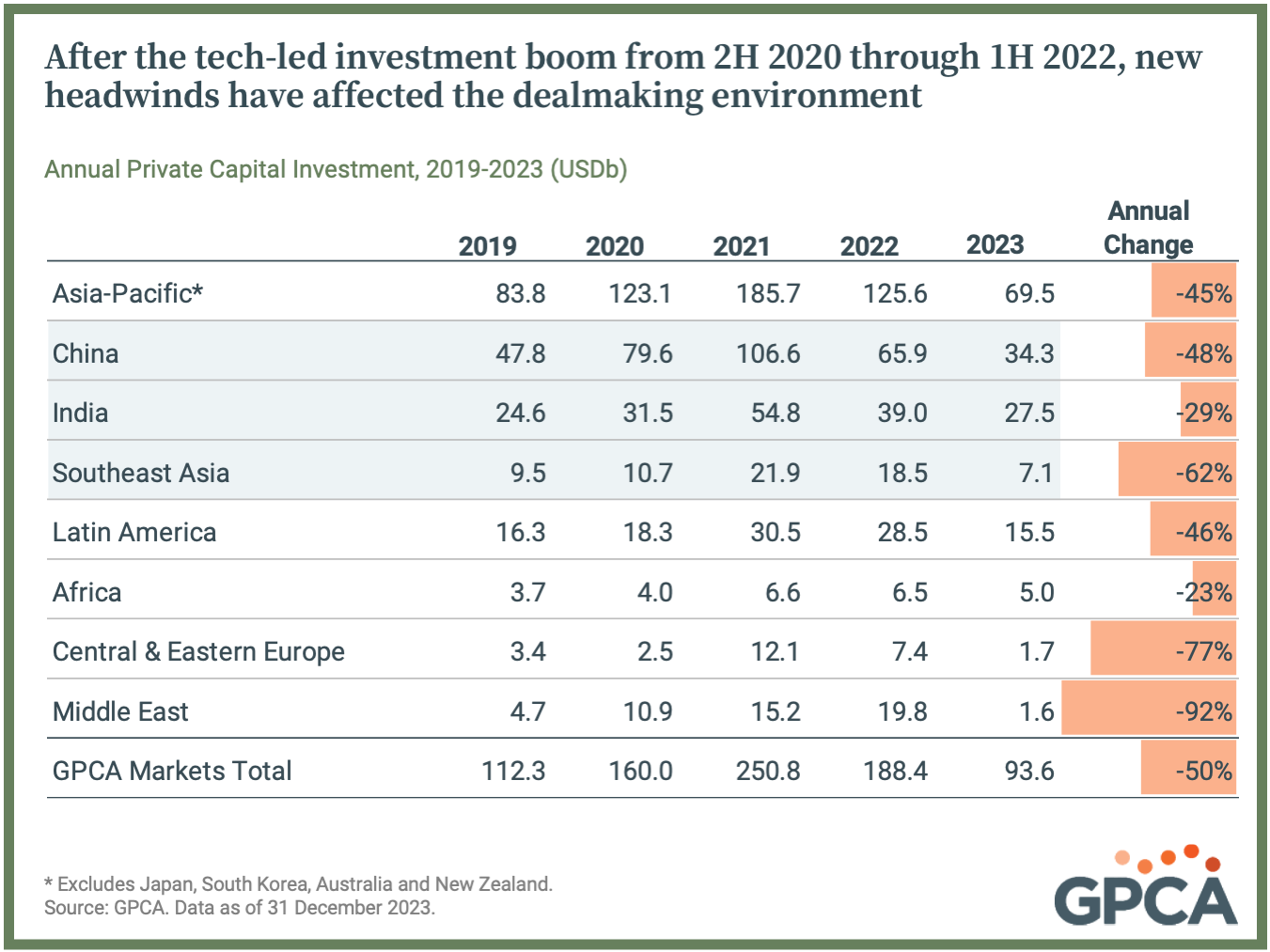

Overall private capital deal value across GPCA’s markets – including Asia, Latin America, Africa, CEE and the Middle East – declined by 50% in 2023, reaching nearly USD94b across 4,416 disclosed transactions.

- After the tech-led investment boom from 2H 2020 through 1H 2022, new headwinds have affected the dealmaking environment – with higher interest rates, inflation, macro uncertainty, war and geopolitical rivalries leading to the largest decline in investment activity globally since 2008.

- The deceleration in deal flow across GPCA markets is in line with trends in the United States and the EU, as reported by NVCA and Invest Europe.

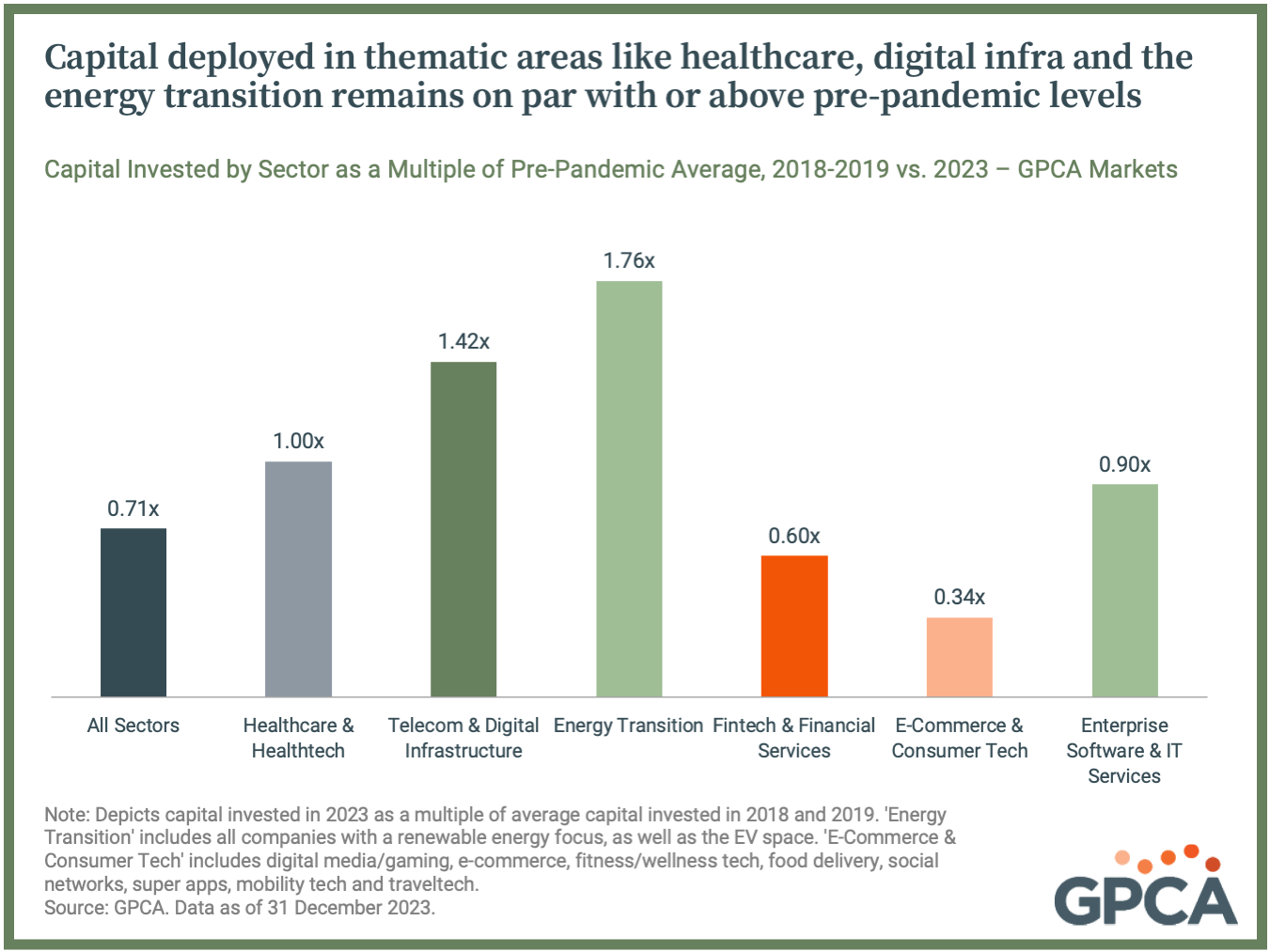

Despite the overall slowdown, capital deployed in select thematic areas like healthcare, digital infrastructure and the energy transition remains on par with or above pre-pandemic levels.

- In Southeast Asia, healthcare deal value increased year over year, led by CVC Capital Partners’ buyout of The Medical City for USD223m and Quadria Capital’s buyout of Straits Orthopaedics for USD135m.

- Brookfield’s USD1.07b commitment to renewable power platform Avaada Ventures and ENGIE and Meridiam’s acquisition of South Africa-based BTE Renewables from Actis for USD1b drove overall investment in energy transition assets across GPCA markets to more than USD13b.

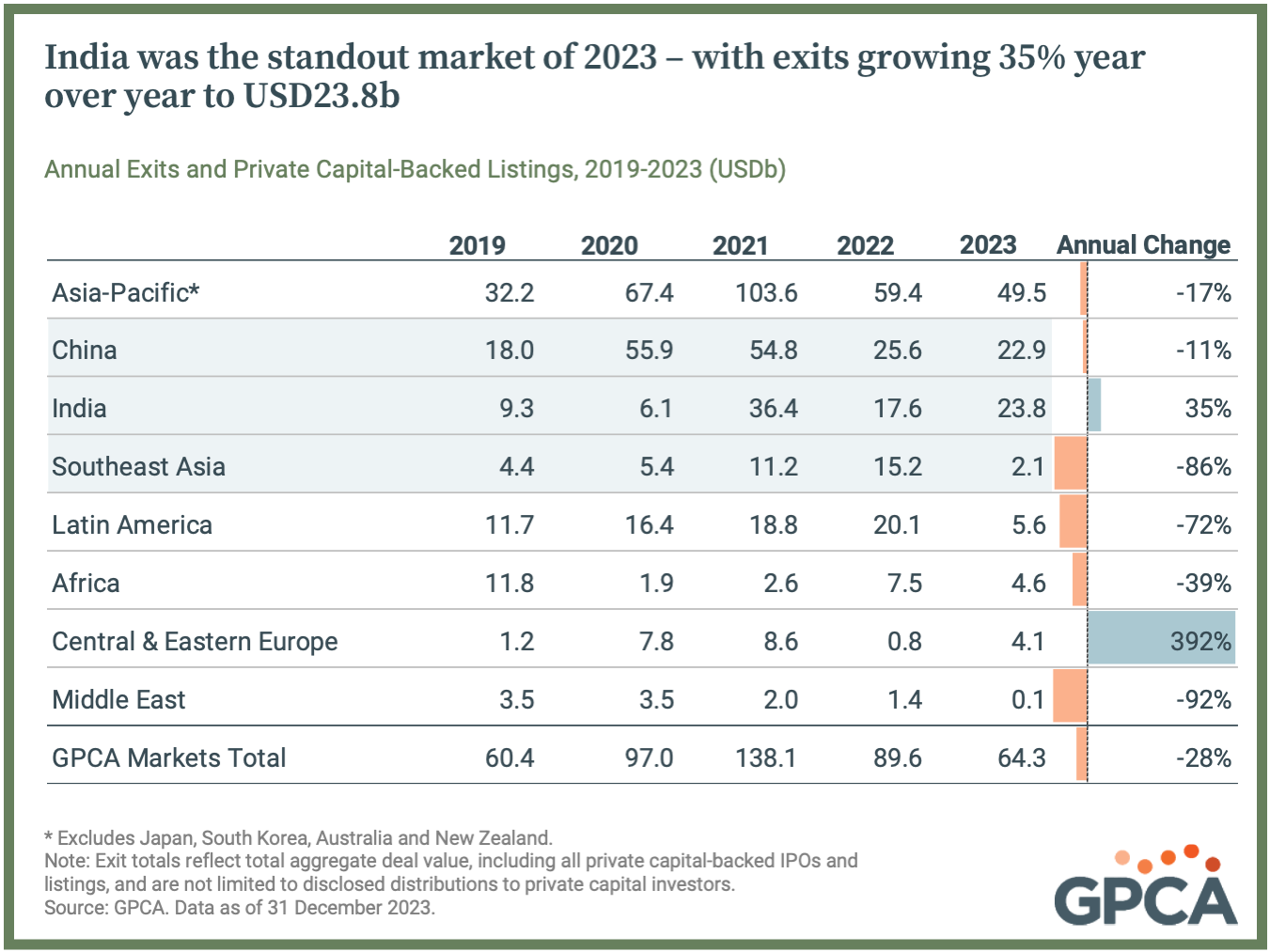

India was the standout market of 2023 – with exits growing 35% year over year to USD23.8b – due to a strong macroeconomic outlook, buoyant public markets and a shift on the part of global investors away from China amidst ongoing geopolitical tensions.

- Notable India exits in 2023 included Walmart’s acquisition of an additional stake in Flipkart from Accel, Tiger Global and others for USD3.5b, NIIF and TPG’s sale of Manipal Health to Temasek for USD2b and BPEA’s full exit of NSE-listed Coforge via block trades for USD924m.

- Disclosed private capital deal value in India declined 29% to USD27.5b in 2023, but capital deployed in Indian infrastructure assets grew 87% to USD7.4b (from USD3.9b in 2022). India accounted for 39% of all disclosed private capital deal activity across Asia in 2023, its highest share on record.

- Fundraising for India-dedicated vehicles fell slightly from USD10.5b to USD9b in 2023, which still represents India’s second-highest year in terms of capital raised. Kotak raised USD1.25b for its Strategic Situations Fund II, Nexus Venture Partners closed its India Fund VII at USD700m and Multiples announced a first close for its Fund IV at USD640m.

Infrastructure vehicles, driven by the digital and renewable energy segments, raised USD11b in 2023, on par with totals for 2022 and 2021.

- Global Infrastructure Partners reached a USD2.6b first close for its debut emerging markets-dedicated fund, the largest disclosed fund close across GPCA markets in 2023. Other notable infrastructure fund closes included multi-regional Climate Investor Two (USD875m) and Seraya SEA Energy Transition and Digital Infrastructure Fund, which raised USD800m.

- The launch of new renewable energy- and digital infrastructure-dedicated vehicles continues to drive dealmaking in these segments. In Africa, AIIM provided USD90m to back N+ONE’s expansion of carrier-neutral data centers across the continent. Beyond specialist funds, experienced PE managers are also deploying capital into the digital infrastructure space. Development Partners International and Verod Capital Management invested in Nigeria-based Pan African Towers, and AfricInvest, Amethis, IFC and Proparco acquired Network Industries and Services from Enko Capital.

Additional data highlights:

- Among all asset classes tracked by GPCA, VC experienced the largest percentage decline in deal value. At USD19b in 2023, total early-stage VC funding (Series A and B rounds) for GPCA markets eclipsed the USD15b deployed in late-stage deals (Series C and beyond), which had reached USD89b in 2021.

- The Middle East was a relative bright spot for VC; widespread adoption of BNPL services across the GCC has driven fintech deal activity, with Saudi-based Tamara (USD340m Series C) and UAE-based Tabby (USD250m Series D) attracting large funding rounds.

- Fundraising for Latin American-dedicated private capital strategies hit its second-highest year on record with USD10.1b secured across 94 funds. Fund closes over USD500m included Mexico Infrastructure Partners’ FIECK 23 placement (USD2.4b), Mubadala Capital’s second Brazil special opportunities fund (USD710m), KASZEK’s sixth early-stage fund (USD540m) and third opportunity fund (USD435m) and Jive’s fourth distressed and special situations fund (USD503m).

- Despite regional geopolitical turbulence and global economic uncertainty, exit value grew nearly 5x in CEE from 2022. CEE remains a growth engine for Europe, and tech talent is a key driver of capital flows to the region, as GPCA Research explores in Private Capital in CEE: Building Businesses Against the Backdrop of a War.

GPCA Members can log in to download the 2024 Industry Data & Analysis Excel file, which contains expanded analysis and commentary; fund and transaction listings; and breakdowns of investment activity by asset class, sector and geography.

For questions and feedback or to request custom data cuts from the research team – including GPCA’s complete fund- and deal-level dataset contact research@gpcapital.org.