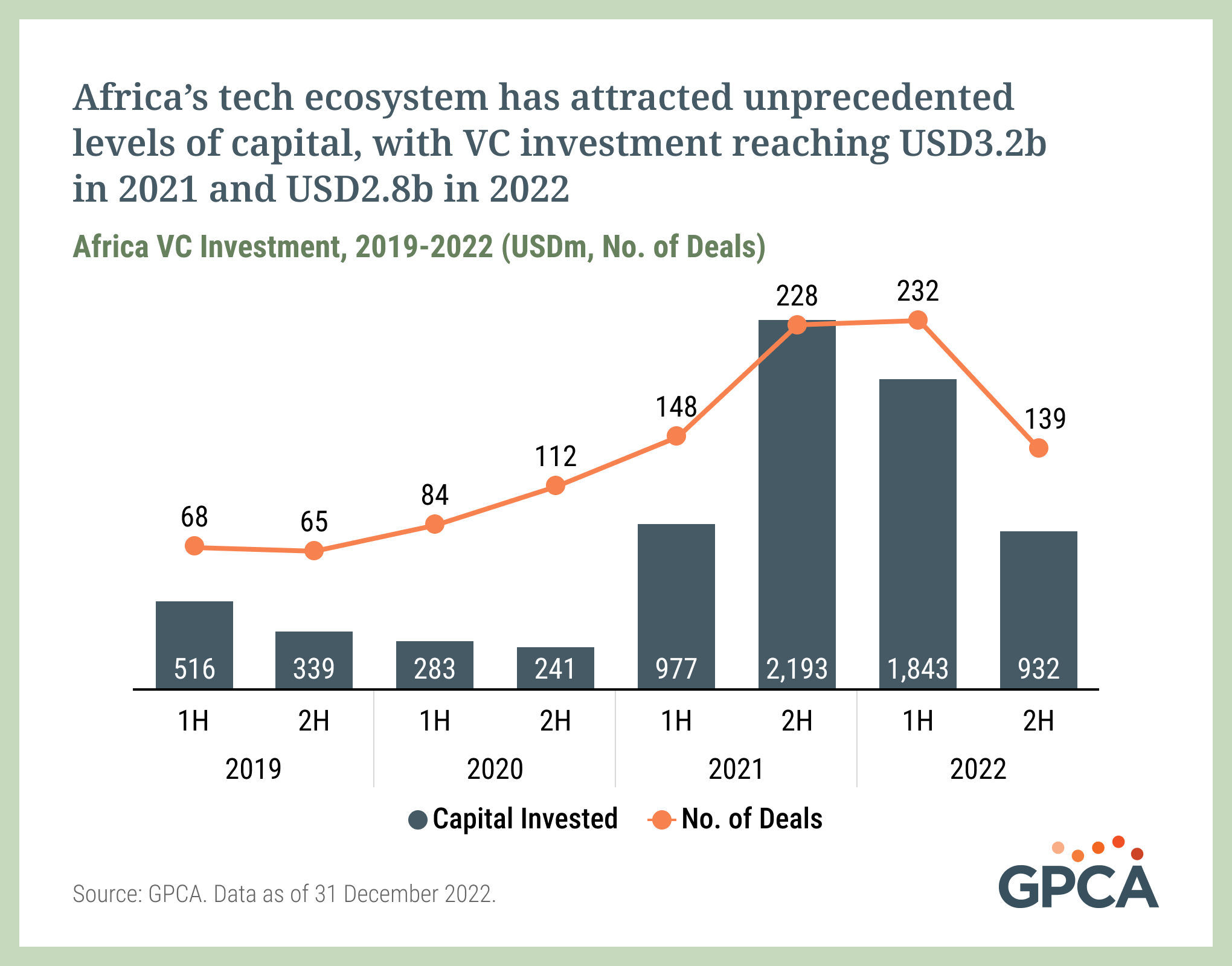

Africa’s tech ecosystem has attracted unprecedented levels of capital over the last several years, with VC investment reaching nearly USD3.2b in 2021 and USD2.8b in 2022. New geographies and tech verticals are also attracting attention despite the global tech correction, including adtech, cleantech, healthtech and proptech.

While international VCs and entrepreneurs have expanded in Africa since 2019, GPCA is tracking a growing ecosystem of local early-stage investors and founders. New analysis from GPCA documents the gender, nationality and educational background of founding teams for African startups.

Activity expanded beyond major hubs and into new geographies in 2022, with investments recorded across 25 countries, compared to 16 in 2019.

Investments in the major markets of Nigeria, South Africa, Kenya and Egypt together accounted for 67% of the region’s deal value in 2022. At the same time, investment activity has increased outside of those hubs, with capital invested growing in 16 different African countries year over year. Francophone startups particularly gained ground, with notable rounds for Senegalese fintech Wave and the DRC’s Web3 startup Jambo. First-time VC investments were recorded in Benin, Madagascar and Sudan.

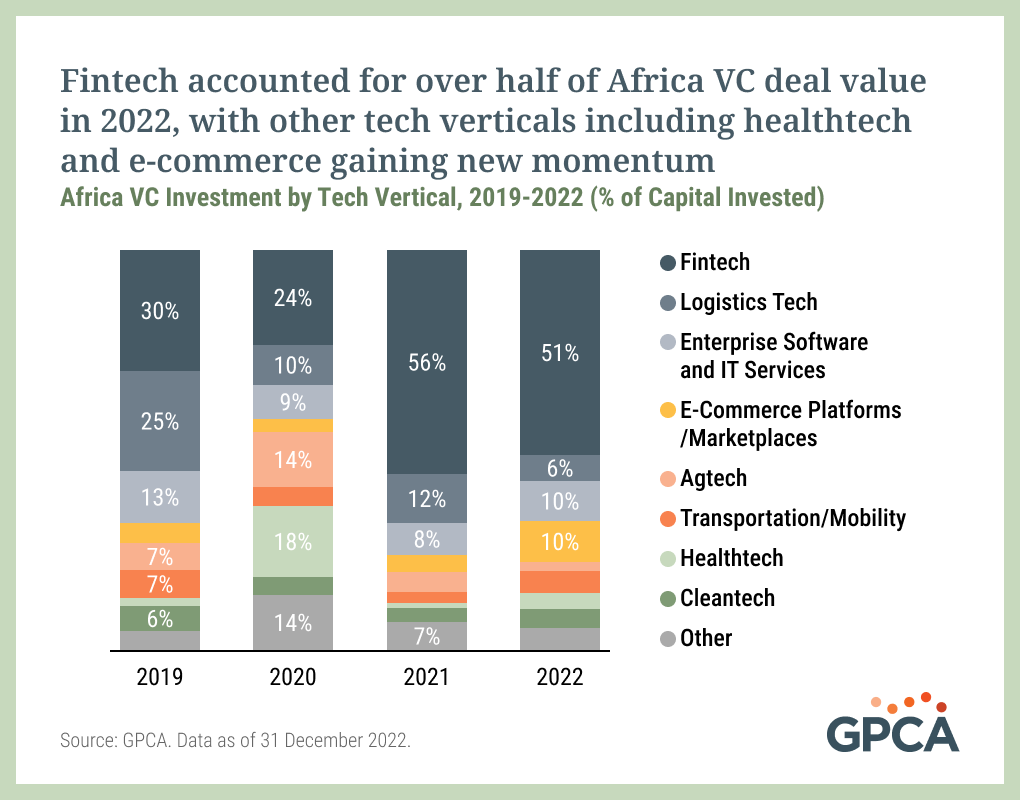

Healthtech, e-commerce and cleantech gained ground despite the correction in 2022.

VC investment in Africa grew to represent 44% of total private capital deal value in 2022, with growth across several tech verticals despite a more cautious investor environment. Investors committed record capital to African healthtech. Reliance Health, co-founded by Obafemi Awolowo University graduates Femi Kuti, Opeyemi Olumekun and Matthew Mayaki, raised a USD40m Series B led by General Atlantic, which marked the first tech investment in Africa for the global firm.

The fintech sector continues to dominate deal flow with over USD1.4b invested in 2022. VC activity increasingly includes startups with embedded finance capacities providing services across sectors. M-Kopa received a USD75m investment in 2022 to further expand its “pay-as-you-go” solar solutions for off-grid customers. AfricInvest joined existing shareholders Speedinvest, Left Lane Capital and thelatest.ventures to invest USD105m in mobility fintech Moove as it aims to expand vehicle financing into new markets.

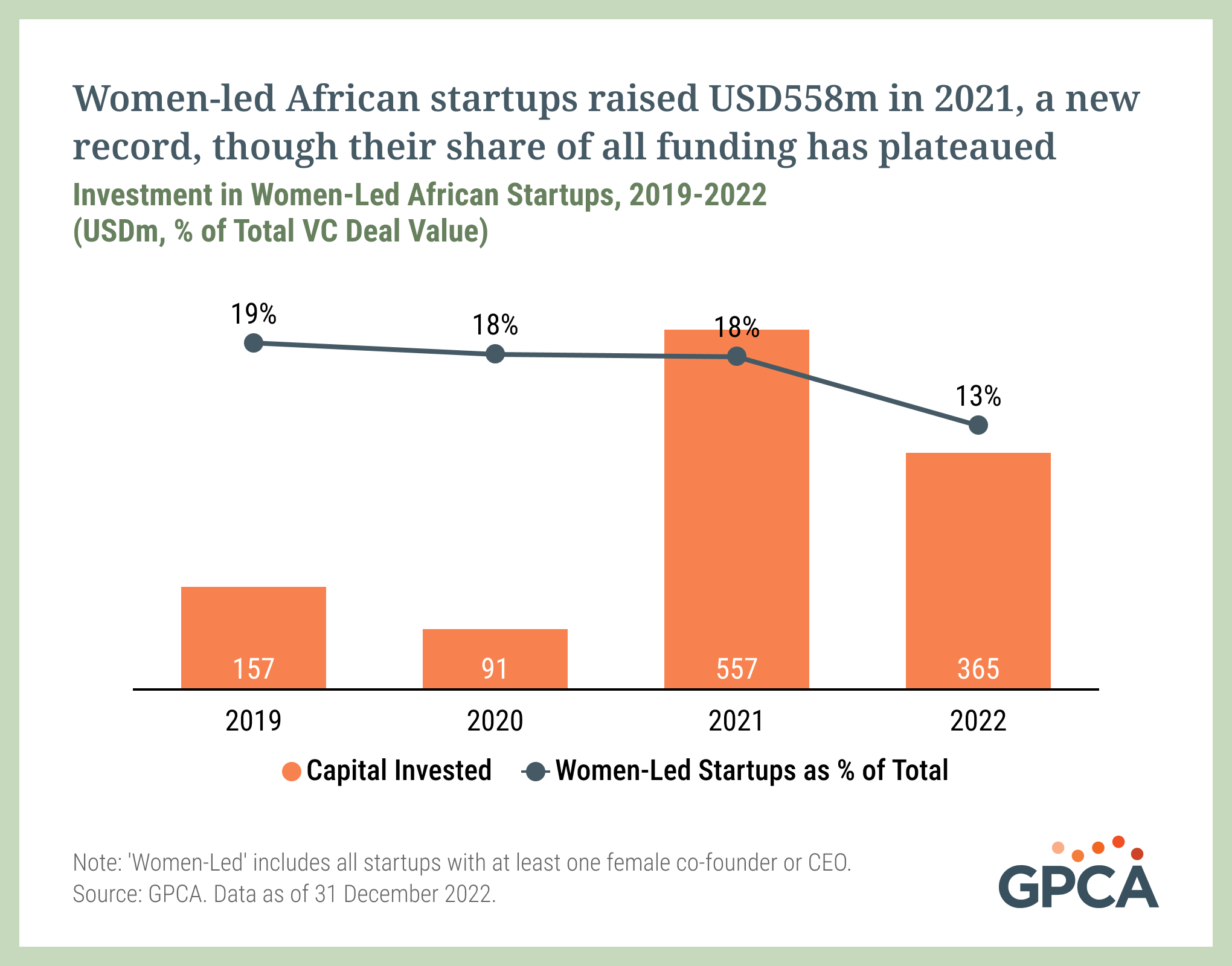

Though investments in women-led startups have increased since 2019, the share of capital going to women founders has been stagnant.

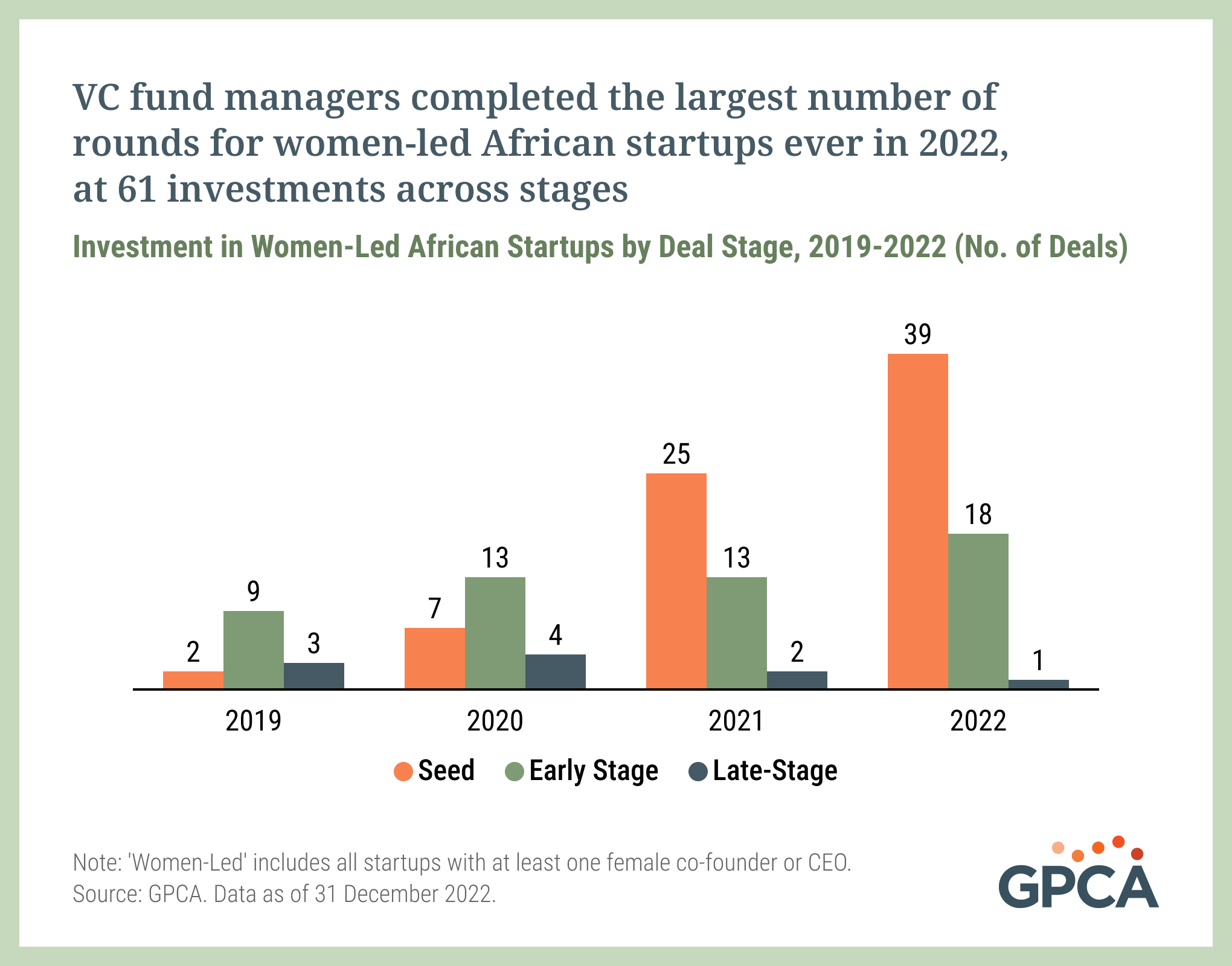

Women-led startups – defined as those with at least one female founder – raised USD365m in 2022, a 133% increase from 2019. The emergence of gender-focused funds like Alitheia IDF and Women’s World Banking has increased dialogue around how gender diversity in the portfolio can translate into significant commercial returns.

Goodwell Investments led a USD50m Series C in Kenya-based Copia Global, co-founded by Tracy Turner, making it the largest transaction into a women-led African startup in 2022. Intel Capital, TPG and EchoVC’s USD85m Series B investment in Gro Intelligence, founded by CEO Sara Menker, was the largest of 2021.

Female founders from North America and Europe captured 60% of capital deployed in women-led startups from 2019 to 2022. Investments into women-led startups are growing most dramatically at the seed and early-stage levels, fueled by emerging gender-focused accelerators, angel networks and early-stage managers. All-male founding teams dominate in later-stage rounds and still reflect the lion’s share of venture capital in Africa at nearly USD2.4b in 2022. All-female founding teams accounted for just 1% of 2022 deal value, highlighting the lingering effects of biases, lack of visibility and limited access to networks on gender inequality in Africa’s tech ecosystem.

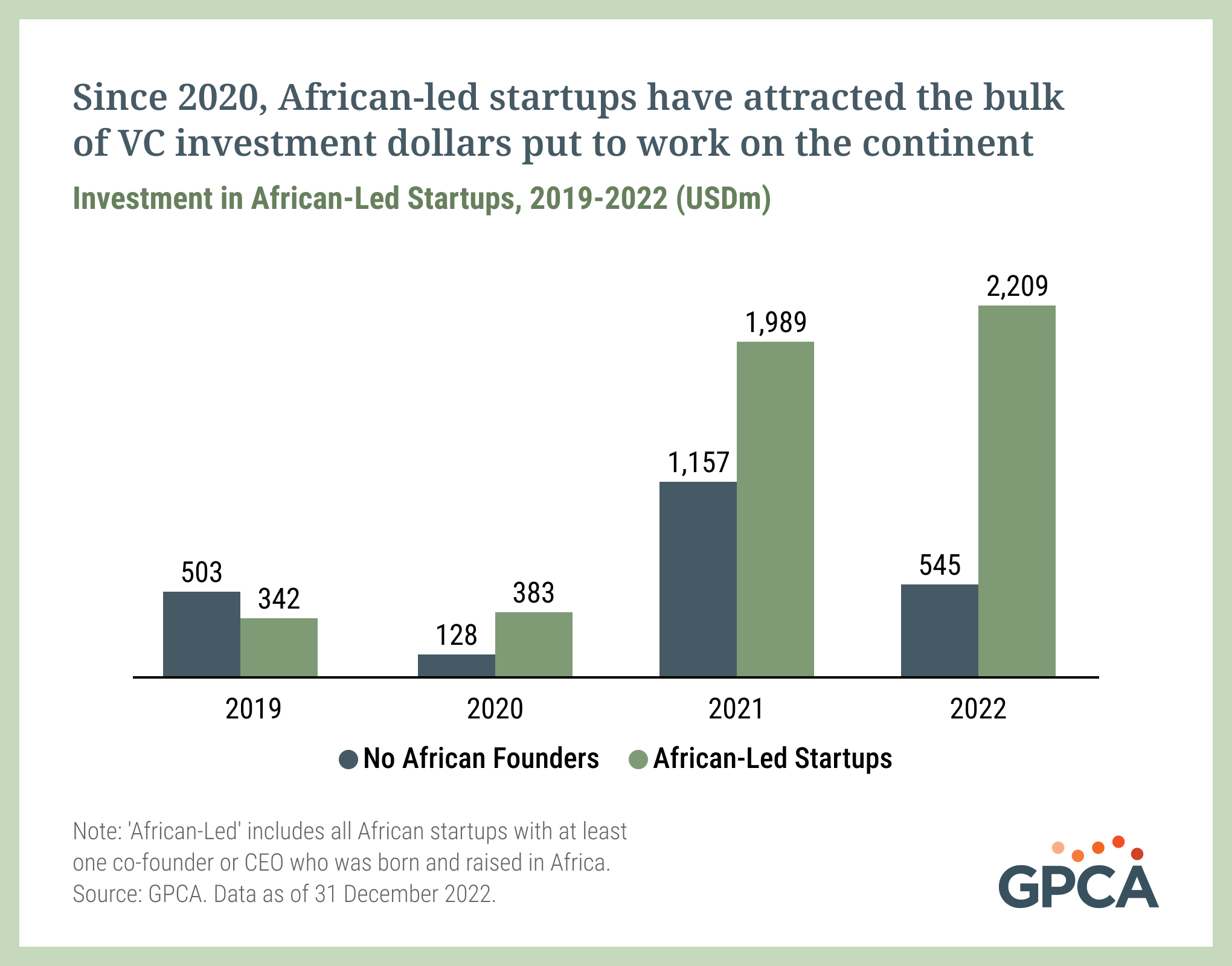

Local founders are anchoring ecosystem growth, with African-led startups receiving a record USD2.2b in 2022, compared to USD342m in 2019.

As African VC activity has grown, African founders now capture the majority of investment dollars. In 2022, startups with at least one African founder attracted a record USD2.2b, signaling growing investor appetite for entrepreneurs with deep, on-the-ground knowledge of African markets. B Capital led Flutterwave’s USD250m Series D, which valued the unicorn (co-founded by Iyinoluwa Aboyeji, Olugbenga Agboola and Adeleke Adekoya) at over USD3b and constituted the region’s largest VC investment in 2022.

An increase in African-founded VC firms is accompanying the rise of indigenous startup talent. Rising dealmakers including Launch Africa Ventures’ Janade du Plessis, LoftyInc Capital Management’s Idris Bello and Ventures Platform’s Kola Aina were amongst Africa’s most active VC investors in 2022.

As a major hub on the continent, Kenya has experienced an influx of international capital and startups launched by foreign entrepreneurs. In 2022, Kenya-based startups led the region in VC funding, with 52% of capital invested in founding teams made up solely of non-Africans. In at least one case, this has led to a press backlash citing foreign founders as less in tune with local needs.

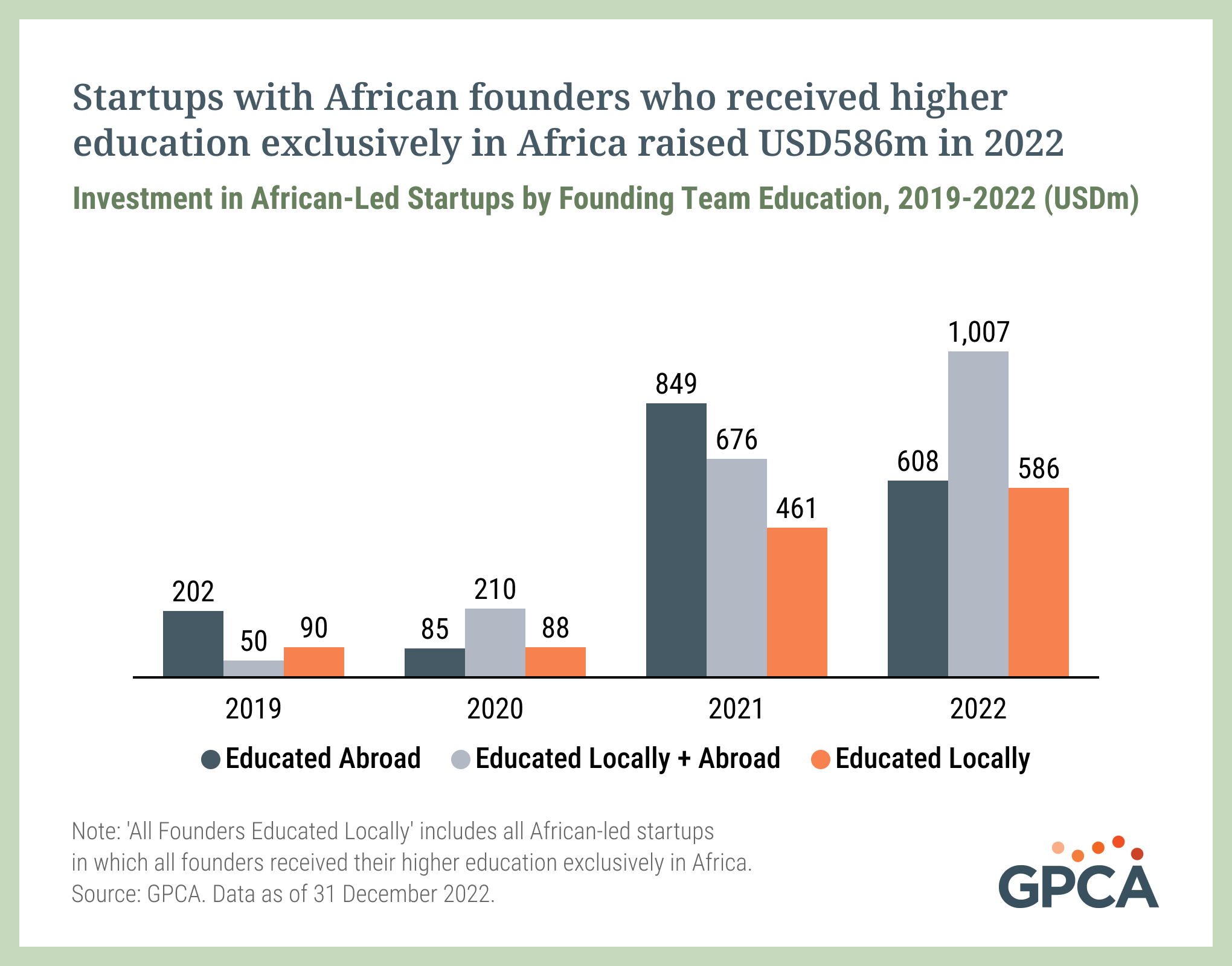

Startup founders educated on the continent are gaining traction.

African-led startups with founders educated exclusively on the continent raised USD586m in 2022, a new record, as entrepreneurs educated locally become increasingly aware of the nuanced VC landscape and create connections to pools of capital. Egypt-based fintech Paymob, co-founded by graduates of the American University in Cairo, raised USD50m in a Series B led by Paypal Ventures and Clay Point. The company represents a local solution to connect Africa’s fragmented payments segments. In Egypt, startup funding has been concentrated in locally educated founding teams, with alumni from international schools such as the American and German Universities in Cairo capturing 57% of VC funding in 2022.

Rising insecurity across the region has caused many to turn abroad for postgraduate education and employment opportunities. Africans in the diaspora gain visibility into trends in business and innovation and develop ties to sources of funding abroad. Startups with founders educated exclusively abroad or with mixed local and international educational backgrounds raised over USD1.6b in 2022, representing 73% of capital invested. Algerian superapp Yassir was founded by Noureddine Tayebi, an alumnus of École Nationale Polytechnique, the University of Illinois and Stanford University. The startup raised a USD150m Series B led by BOND with participation from Quiet Capital, Spike Ventures (Stanford Alumni) and others, illustrating how founding teams with both local and international education leverage global networks.

In Nigeria, university strikes and scarce employment opportunities have heightened ‘japa’ syndrome (Nigerian slang for emigration) amongst the country’s tech talent. Nigerian startups with at least one founder educated abroad received 67% of capital invested in 2022.

About this Report: Founding Team Demographics Methodology

This report includes information about the demographic characteristics of founding teams based on gender, nationality and location of higher education. The pool of startups for this report was sourced from GPCA’s venture capital (VC) dataset, which includes investments into startups with participation from at least one VC fund manager. To qualify for inclusion in the founder demographics analysis, Africa-based startups must have received a VC investment of at least USD500k in a single round from 2019 to 2022. Information about founders was sourced from startup websites, founders’ LinkedIn pages and media interviews featuring founding teams. The following definitions are used throughout the report:

- Women-led startup: a qualifying startup with at least one woman founder or CEO.

- African-led: a qualifying startup with at least one co-founder or CEO born and raised in Africa.

- Locally educated: a qualifying, African-led startup with all founders completing higher education exclusively in Africa.

- Educated abroad: a qualifying, African-led startup with no co-founders completing higher education in Africa.

- Educated locally and abroad: a qualifying, African-led startup with founders completing some degree of higher education in Africa and some degree of higher education abroad.

Underlying data from the report is available to GPCA Members upon request. Contact Toluwani Adedeji at tadedeji@gpcapital.org to learn more.