This report delves into the latest fintech developments in India and highlights the evolution of major private capital investment themes based on GPCA’s proprietary dataset and discussions with GPCA Members.

Key Takeaways:

Key Takeaways:

- India has become a vibrant center of fintech innovation on the back of growing digital adoption, demographic tailwinds and government initiatives, with UPI standing out as the most transformative. Digital payments now account for 40% of total payments in India compared to 10% in 2016 – before UPI was developed.

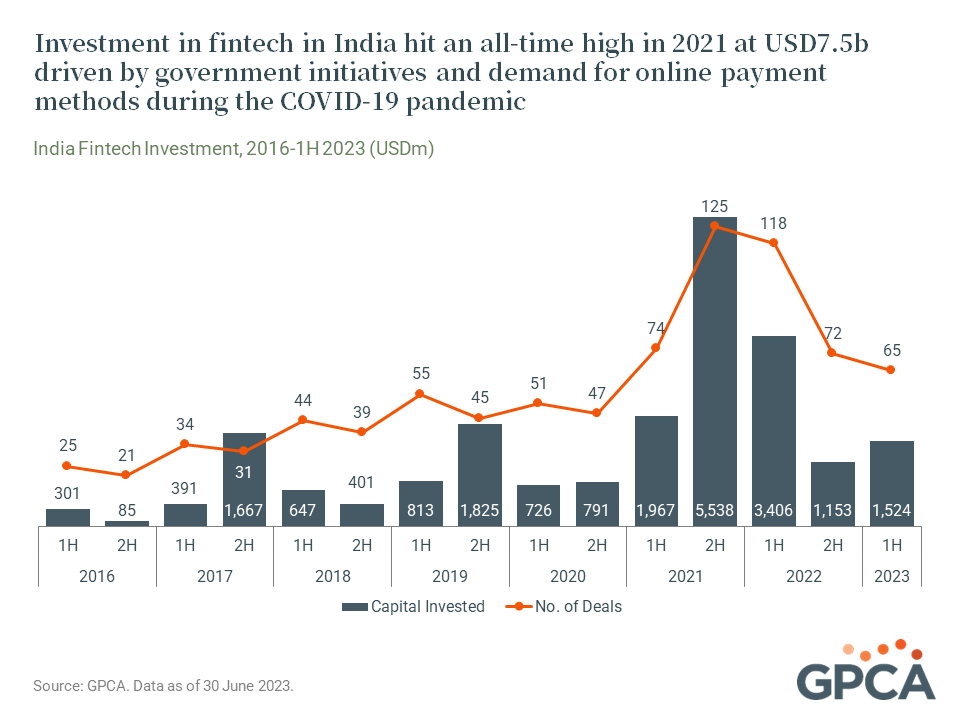

- Private capital investment in fintech in India hit an all-time high in 2021 at USD7.5b, building on momentum from government initiatives and heightened demand for online payment methods during the COVID-19 pandemic. After a lull in 2022, investment in Indian fintech recovered in 1H 2023, reaching 1.5b.

- Companies such as PhonePe, Pine Labs, Razorpay and BharatPe raised large private capital rounds during the pandemic period and continue to hold dominant market positions in the P2P and P2M segments today. PhonePe, Paytm and Google Pay hold 95% market share in payments, and the top five companies have accounted for 72% of payments investments in India since 2016.

- Penetration levels for both insurance and credit in India remain below those of developed economies. Recent developments such as identity verification through UPI and demand for digital-first products provide pathways for growth and mass adoption of insurance and credit in India.

- Fund managers who spoke with GPCA for this report identified new growth areas, including cross-border payments, general insurance, niche financial services targeting specific industries or demographic groups, microcredit and virtual credit, as well as layered or integrated digital financial services offerings.