Mid-Year 2023 Industry Data & Analysis

GPCA’s Mid-Year 2023 Industry Data & Analysis features in-depth private capital data, commentary and analysis on key trends across global markets.

Key data takeaways:

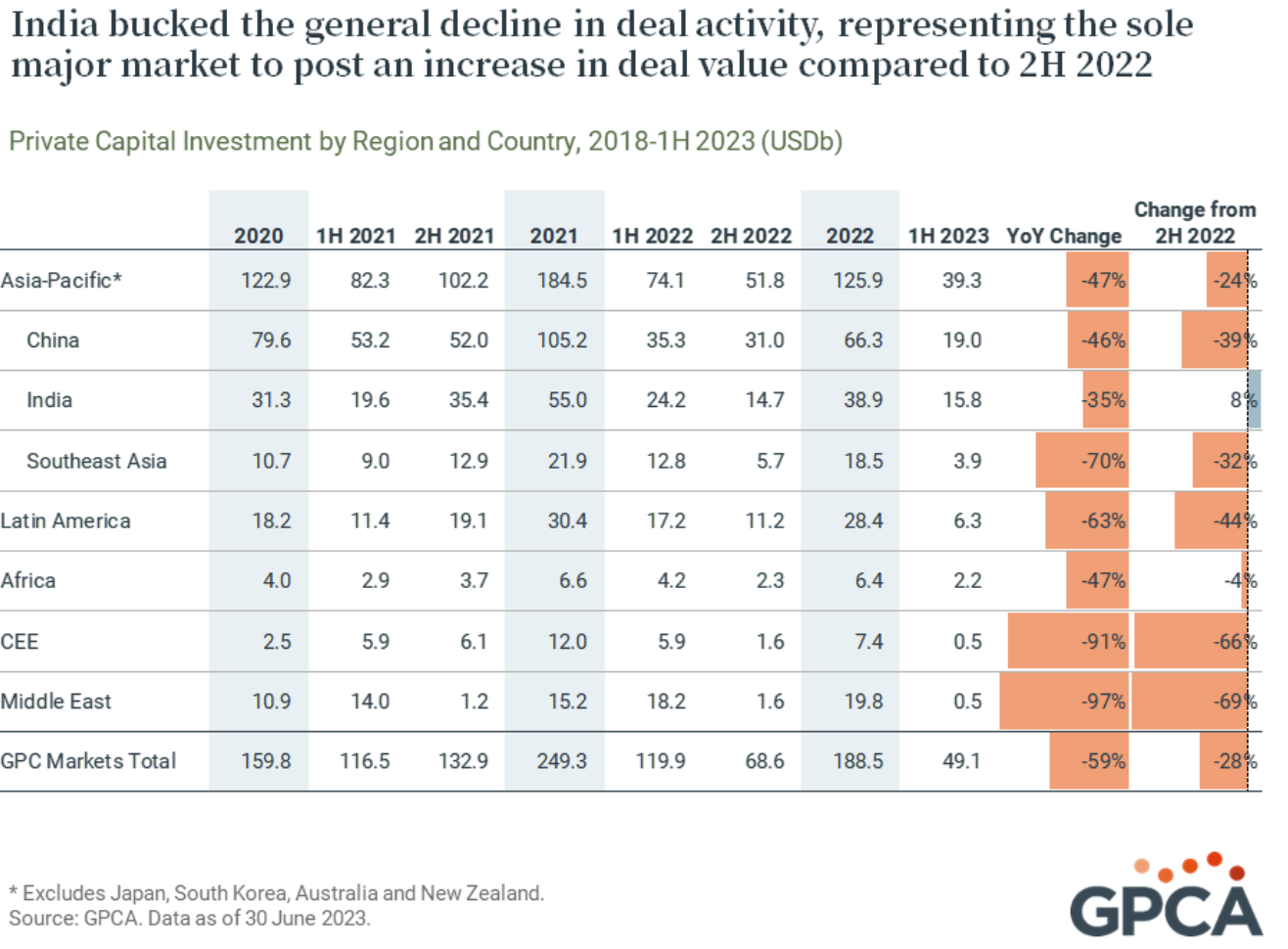

- Overall private capital deal value across GPCA’s markets in 1H 2023 reached USD49b, a 59% decline year over year and a 28% decrease compared to the second half of 2022. Deal activity has decelerated after two record years of private capital flows.

-

- Healthcare was one of several bright spots amidst the global dealmaking slowdown, with USD7b deployed in the sector across all of GPCA’s markets, up from USD6.6b in 2H 2022. CPP Investments, Farallon and Lumina’s USD505m debt restructuring for Andean healthcare provider Grupo Auna was among the largest deals in the sector.

- India also bucked the general decline in deal activity, representing the sole major market to post an increase in deal value compared to 2H 2022. The country has also proved to be a major destination for healthcare deals, led by Blackstone’s buyout of India-based CARE Hospitals for USD560m and Bain Capital’s acquisition of Porus Laboratories for USD290m.

- Be on the lookout for an upcoming GPCA report on healthcare investing in Asia.

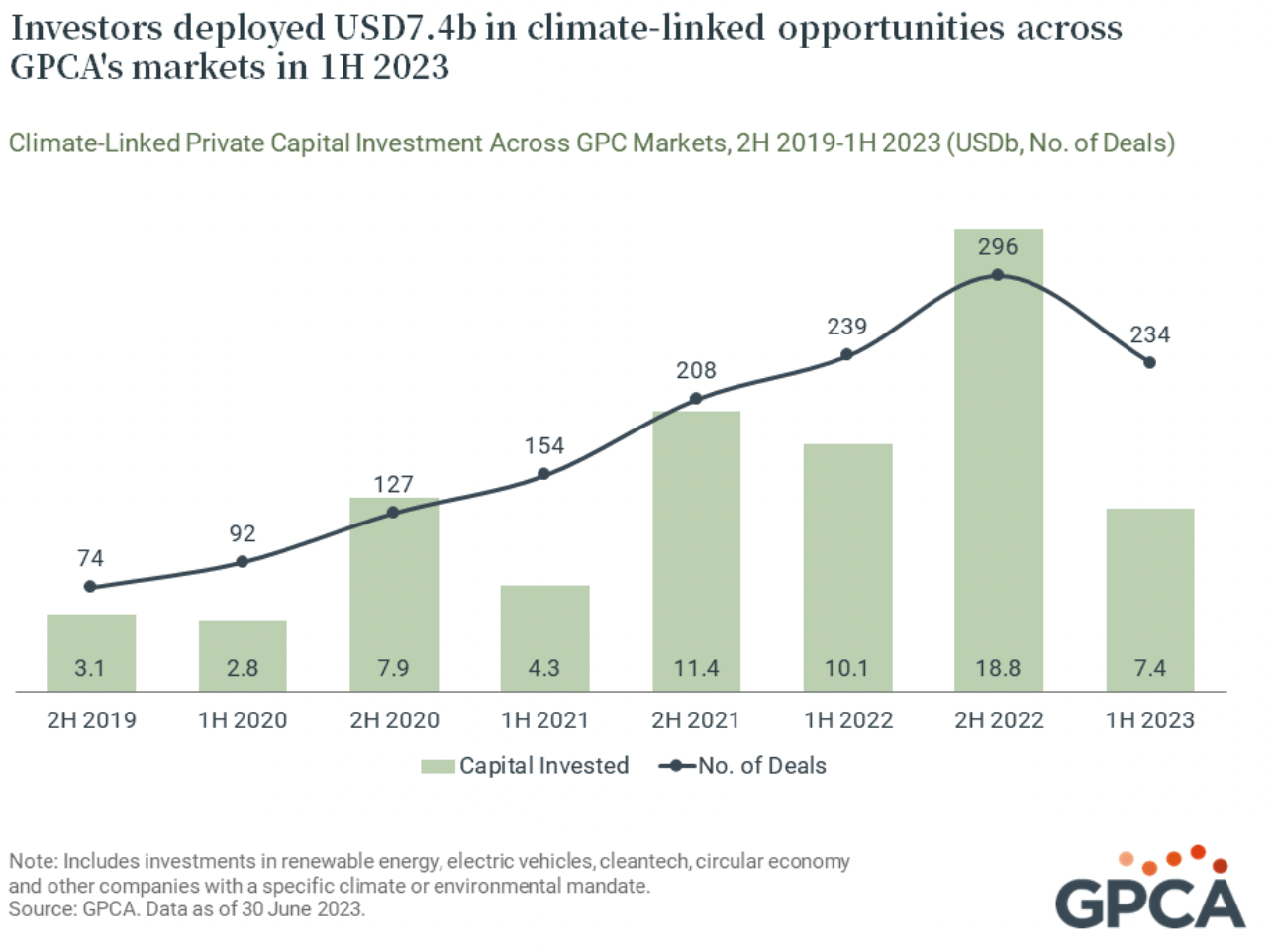

- Capital deployed in climate and sustainability-linked opportunities – including renewable energy, electric vehicles, cleantech and circular economy assets – remained above historical levels at USD7.4b in 1H 2023. Climate-linked investments were down from the high water mark of 2H 2022, however, which was boosted by record commitments to Chinese EV companies.

-

- CEE’s sustainable startups attracted record capital in 2022 driven by EV startup Rimac’s EUR500m funding round. The trend continued in 1H 2023, with Czech Republic-based sustainable heating company Woltair raising USD22m in early-stage funding and Bulgaria’s Ampeco, which produces EV charging management software, raising a USD16m Series A.

-

- Cleantech has represented an outsized opportunity for VC investors in Africa within a more cautious deal environment: the USD255m equity and debt round for off-grid solar platform M-Kopa was the largest disclosed VC investment in Africa in 1H 2023.

- In India, Brookfield Global Transition Fund committed USD1.07b and USD360m to renewable power platforms Avaada Ventures and Cleanmax Solar, respectively.

- This fall, GPCA will release a new report mapping climate funds in global markets.

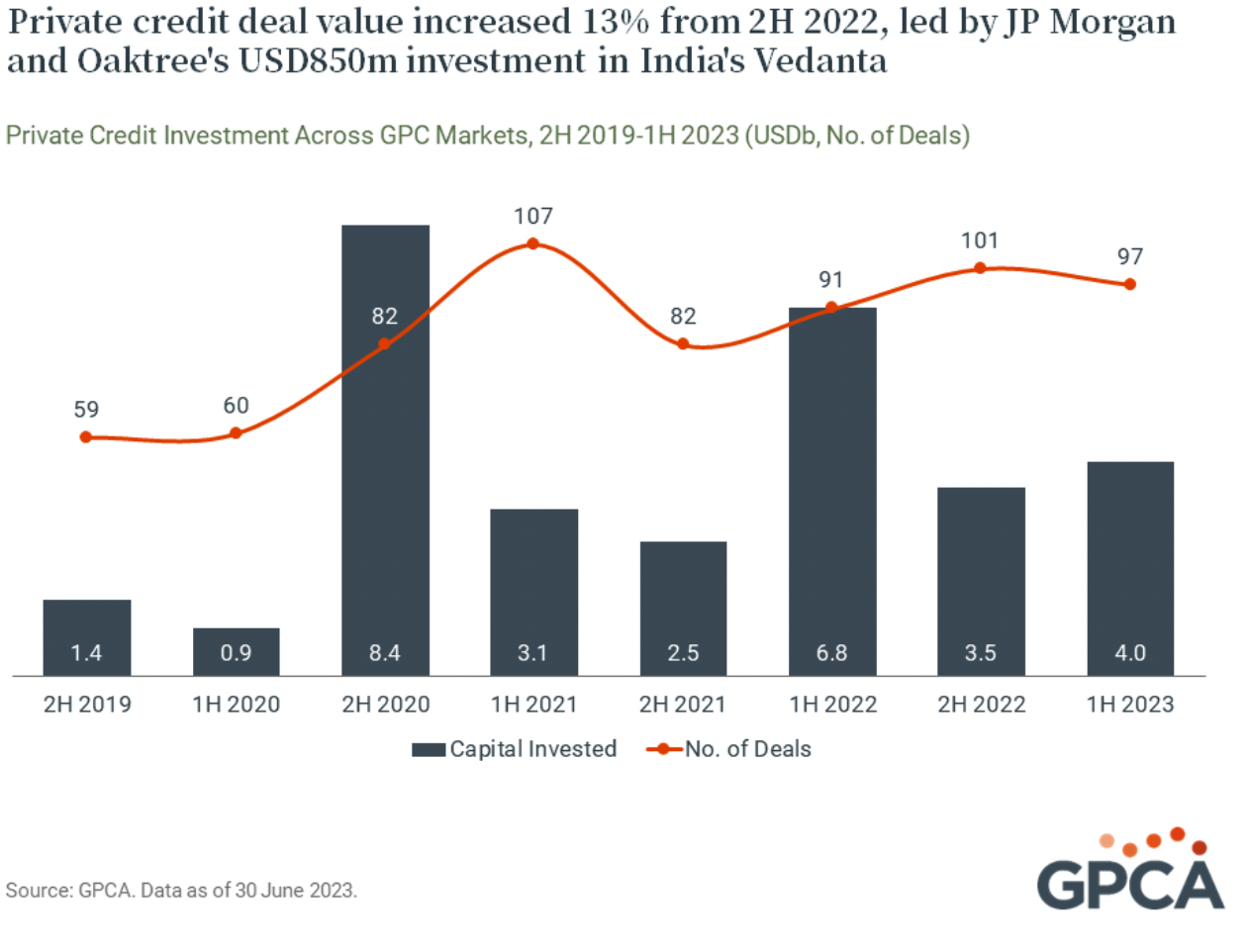

- Private credit deal value across GPCA’s markets increased from the second half of 2022, with both traditional businesses and tech startups looking for flexible financing solutions amid economic uncertainty and a slowdown in equity funding.

-

- Three out of the five largest deals closed in Latin America were private credit transactions, with private credit (inclusive of venture debt) accounting for 37% of the total investment value in the region. The largest Latin America deal completed in 1H 2023 was the ~USD578m in debt financing for the Bogotá-Girardot highway in Colombia by BlackRock, local GP Union para la Infraestructura and a consortium of banks.

- J.P. Morgan and Oaktree’s USD850m financing of India’s Vedanta was the largest disclosed private credit transaction recorded across GPCA’s markets in the first half.

- UAE-based fintech Tabby raised USD150m in venture debt from Atalaya, Coventure and Partners for Growth in addition to USD58m in Series C equity funding from investors including Endeavor Catalyst, Mubadala and Sequoia.

- Experienced GPs drove an increase in fundraising from 2H 2022 in certain geographies, including Africa, India and Latin America.

-

- GPs raised USD1.9b across 22 funds in the first half for Africa-focused funds, a 72% increase from 2H 2022, including first closes for successor vehicles Adenia V (USD300m), Partech Africa Fund II (USD262m), Amethis III (USD150m) and uMunthu II (USD61m).

- Closes for KASZEK and Bicycle Capital, the latter founded by former SoftBank partners, accounted for a third of the USD4.2b raised for Latin America funds in 1H 2023.

- Fundraising for India was led by Kotak (USD1.25b and USD590m for special situations and data centers, respectively), Nexus India Capital VII (USD700m), Multiples IV (USD640m) and Matrix India IV (USD550m).

- In China, Qiming Venture Partners raised USD958m for its seventh RMB fund; 23 of the 27 China-dedicated funds holding a close in the first half of 2023 were RMB-denominated.

- Local public market activity contributed to slight year-over-year gains for India and China exit values.

-

- Mainland exchanges accounted for 72% of the 36 private capital-backed IPOs for Chinese companies in Q2 2023. Along with the rise in RMB fundraising, this trend points to the increasing localization of private capital in China amidst current headwinds.

- Overall exits in India were up 52% year over year in 1H 2023, reaching USD10b, as investors look to take advantage of momentum in Indian public markets. Notable India exits in 1H 2023 included TPG and NIIF’s exit of Manipal Hospitals through Temasek’s buyout for USD2b, Blackstone exiting Sona Comstar via block trade for USD598m and Advent and Ashmore exiting CARE hospitals via Blackstone’s buyout for USD560m.

GPCA Members can log in to download the Mid-Year 2023 Industry Data & Analysis Excel file, which contains expanded analysis and commentary; fund and transaction listings; and breakdowns of investment activity by asset class, sector and geography.

For questions and feedback or to request custom data cuts from the research team – including GPCA’s complete fund- and deal-level dataset – please contact research@gpcapital.org.