GPC 1H 2021 data on fundraising, investment and exit activity across Asia, Latin America, Africa, CEE and the Middle East

Key data takeaways:

All major markets posted year-over-year gains in private capital deal value and deal count as the tech-fueled recovery from the pandemic continues.

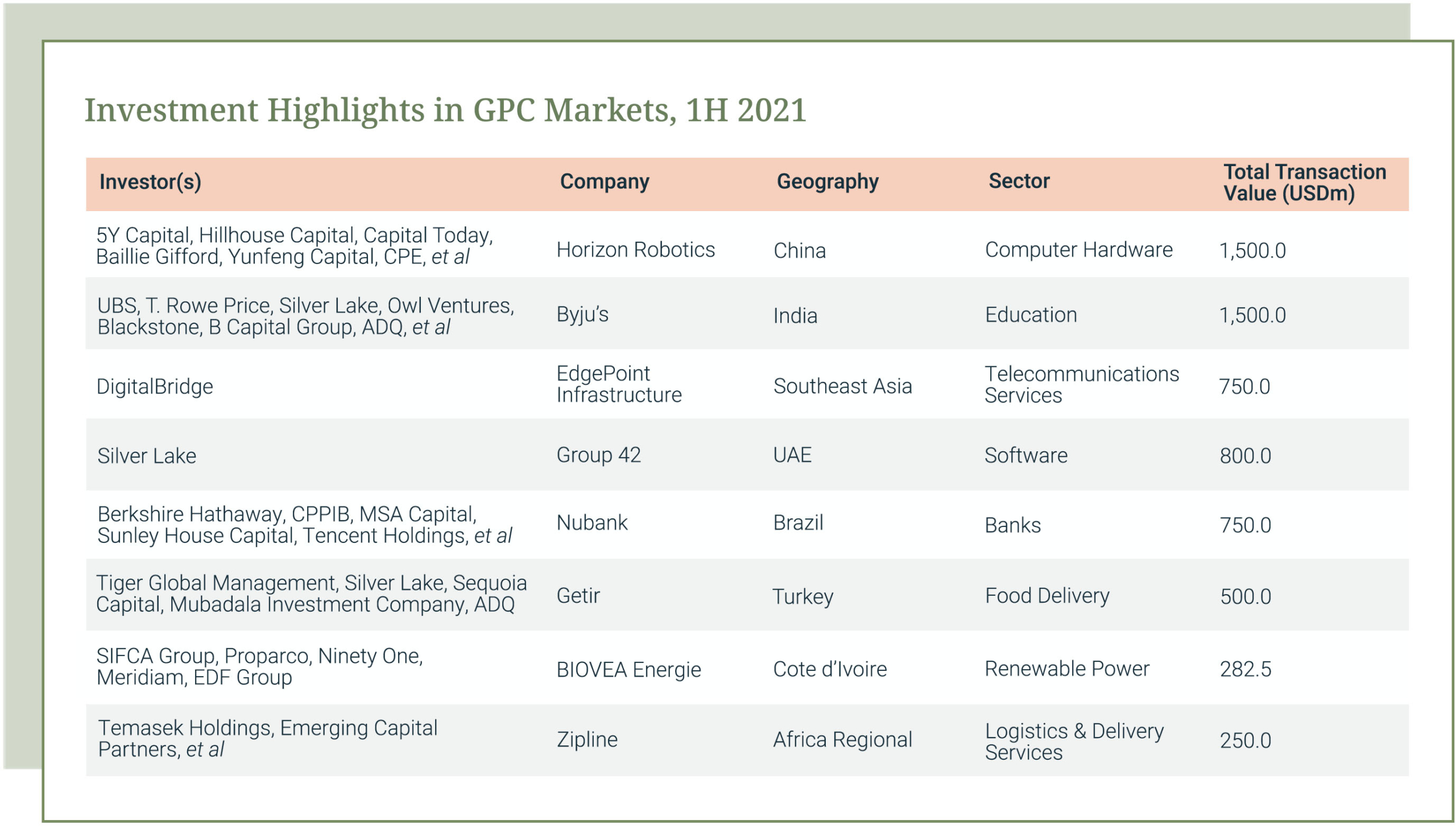

- VC deals drove the increase across China, India, Southeast Asia, Latin America, Africa, CEE and the Middle East. Companies such as Indian edtech Byju’s (USD1.5b in funding), Brazil-based Nubank (USD1.15b across two rounds) and Turkey-based e-commerce/delivery platform Getir (USD928m across three rounds) raised expansion capital from local and international investors to meet pandemic-fueled demand for online services.

- PE investors, large pensions and sovereign wealth funds, which backed Asian startups in recent years, are now playing a greater role in tech funding rounds in Latin America and Africa. CPP Investments participated in a USD425m round for Brazil-based Loft in 1H 2021, while Africa-focused drone delivery service Zipline’s latest USD250m round included Temasek Holdings and pan-Africa PE firm ECP.

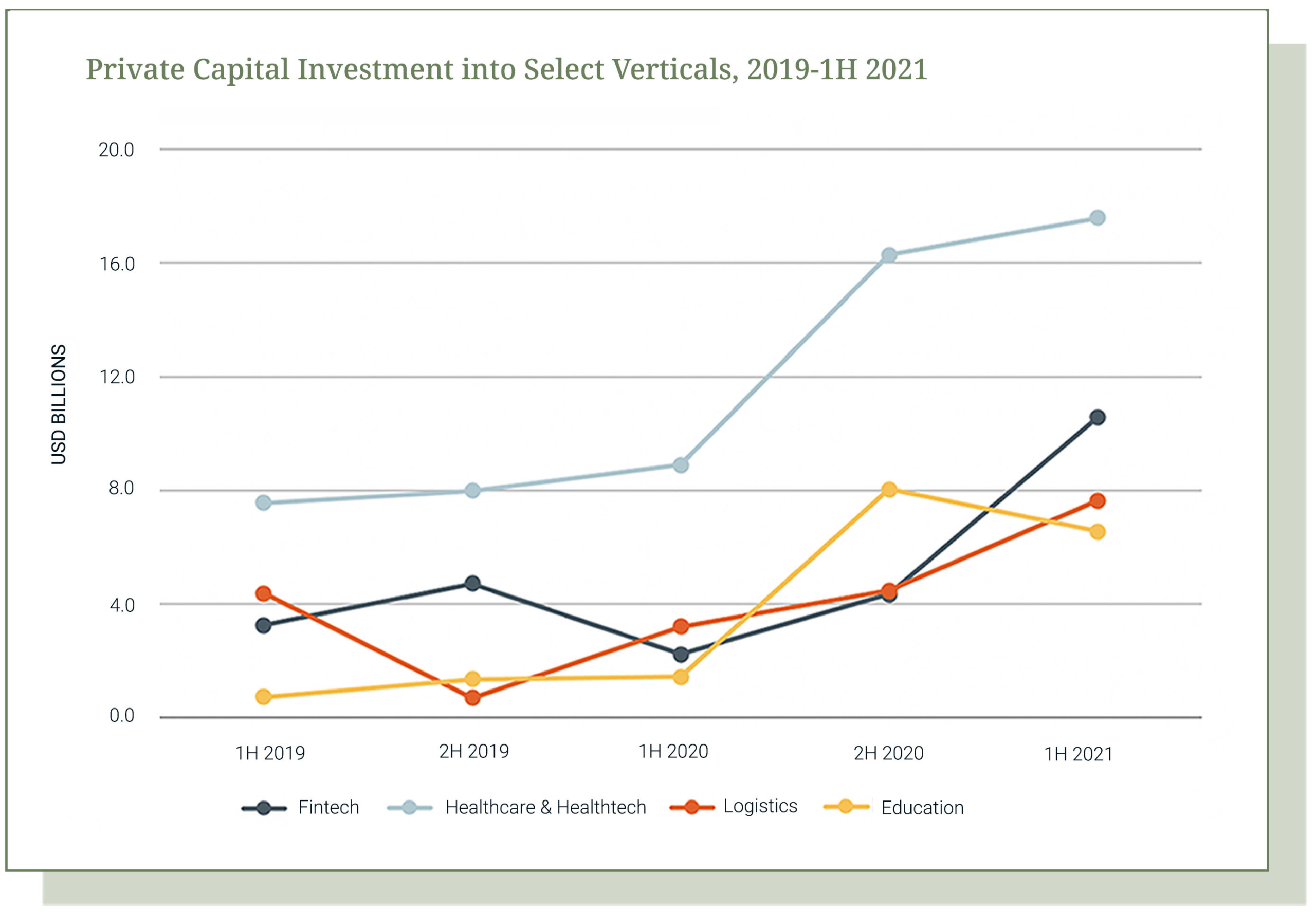

Investment in the logistics space doubled from 2H 2020 as businesses across markets navigate online fulfillment and COVID-related supply-chain disruption. |

|

Fintech and healthcare remained dominant investment themes.

|

|

Exit activity accelerated in Asia and CEE, with strong public markets appetite for private capital-backed businesses driving gains.

- Exit activity in India reached USD11.7b in the first half of 2021, surpassing the 2020 full-year total. The first-half total does not include food delivery startup Zomato, which raised USD1.3b in a local listing in July. Zomato represents the first in an expected wave of 2H local listings for Indian startups including Paytm, Delhivery and Flipkart.

- Romania-based UiPath’s USD1.3b IPO was the largest ever US listing for an Eastern European tech startup and perpetuated a run of public market exits for CEE-based companies. The listing provided exits for Kleiner Perkins, Earlybird Venture Capital, Coatue Management, Accel and others.

- Southeast Asian companies are being heavily targeted by SPACs. The largest transaction, Grab’s USD40b merger with Altimeter Growth, is expected to close in 2H 2021 . Other targets include Indonesia-based FinAccel and Singapore-based PropertyGuru. Middle Eastern startups have also seized this new path to a US listing, with Anghami and Swvl set to merge with Nasdaq-listed SPACs later this year.

Established fund managers are attracting a growing share of all capital commitments to funds targeting GPCA’s markets, as emerging managers face COVID-induced delays.

- Fundraising represented a more mixed picture across GPCA’s markets, with only China and Latin America posting year-over-year gains in capital raised.

- Established managers, such as Boyu Capital Management, Matrix Partners, LAV, Orchid Asia Group and 5Y Capital in China and KASZEK in Latin America accounted for most of the new capital raised for these geographies.