Q3 2023 Industry Data & Analysis

GPCA’s Q3 2023 Industry Data & Analysis features in-depth private capital data, commentary and analysis on key trends across global markets.

Key data takeaways:

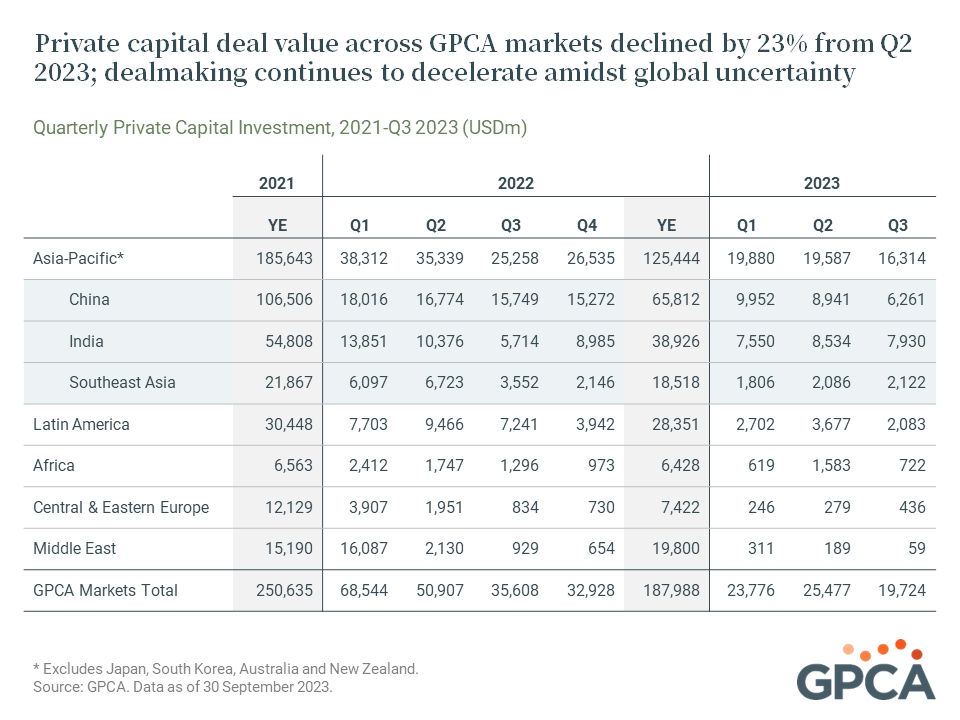

Private capital investment in GPCA markets – including Asia, Latin America, Africa, CEE and the Middle East – fell to USD19.7b in Q3 2023, continuing the broader market slowdown seen over the past 18 months.

- While private equity (PE) deal value shows signs of stabilizing, market uncertainty and valuation adjustments continue to depress activity in the venture capital (VC) ecosystem. VCs have deployed USD28.3b in GPCA markets so far in 2023, a decline of 63% compared to Q1-Q3 2022.

- The decline in VC, previously concentrated in late-stage rounds, has also spread to seed and early-stage investment activity. Overall VC funding declined to USD8.7b in Q3 2023, its lowest point since Q1 2017.

- CEE emerged as the sole GPCA market in Q3 2023 with a significant quarterly increase in private capital deal value, driven by new rounds for Lithuania-based software companies: PVcase and Nord Security each raised USD100m from investors including Highland Europe, Burda Principal Investments and Warburg Pincus. Horizon Capital also led a USD70m Series C extension for Preply, a Ukrainian-founded language learning platform, in CEE’s only disclosed late-stage VC transaction of 2023.

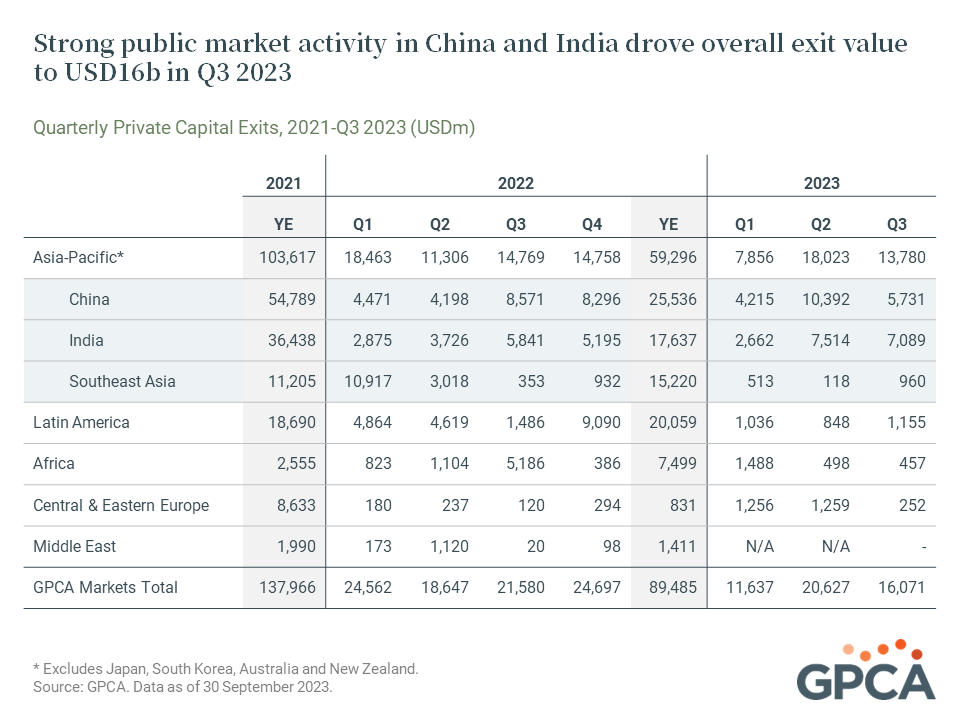

Despite a deceleration in investments, exit activity has remained resilient, totaling USD48.3b thus far in 2023, led by strong public market activity in China and India.

- Private capital-backed listings have gained back some momentum in China, with 92 IPOs recorded in Q1-Q3 2023 marking a substantial increase from 73 in 2022 and 68 in 2021. Notably, the majority of these companies have listed on domestic exchanges after regulatory crackdowns have dampened US interest.

- The exit landscape has brightened in India, propelled by a public market rally and notable strategic sales. Walmart paid USD1.4b to increase its stake in Flipkart, acquiring interests from Tiger Global and Accel in the largest disclosed exit of Q3 2023.

- BioNTech successfully finalized its acquisition of InstaDeep, an AI industrial decision-making platform founded in Tunisia and backed by AfricInvest, Endeavor, Google and others, for ~USD399m. InstaDeep was previously featured in GPCA’s Deal Book.

- Year-to-date exit value in CEE is more than triple the full year total of 2022, led by Advent’s ~USD806m partial sale of InPost in May 2023.

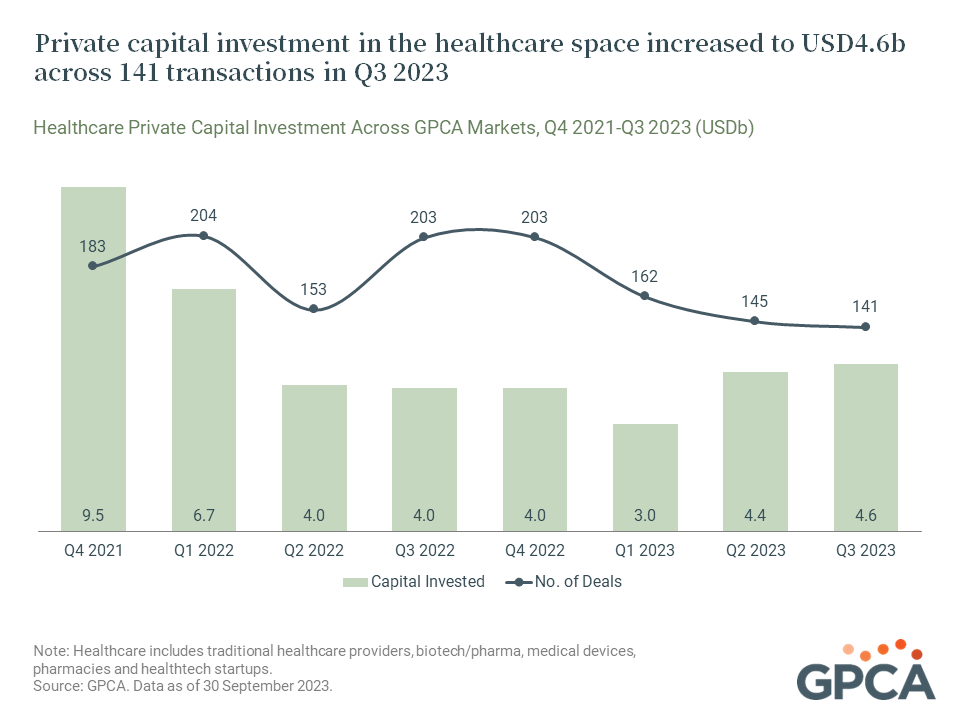

Demographic trends and rising demand for services continue to fuel investor interest in the healthcare space, with USD12b deployed across GPCA’s markets so far in 2023.

- India has accounted for three of the five largest healthcare deals in GPCA markets in 2023, underscoring continued investor interest in improving healthcare accessibility and backing the nation’s maturing pharmaceutical players. Notably, this year already stands as the second-highest on record for healthcare investment in India, with Advent’s USD760m majority acquisition of Suven Pharma the largest disclosed deal.

- Latin America healthcare deal value has surpassed all previous annual totals, reaching USD1.4b, led by Farallon and Lumina’s USD505m debt restructuring for Andean healthcare provider Grupo Auna.

- Read more on healthcare investment trends in GPCA’s recent release Healthcare in Asia: The Growing Opportunity for Private Capital.

Additional data highlights:

- Baring Private Equity Asia and ChysCapital’s USD1.1b buyout of Credila Financial Services was the largest disclosed deal across GPCA markets in Q3 and represents the largest disclosed buyout of an Indian financial services company on record, according to GPCA Research.

- Fundraising for Middle East-focused private capital vehicles has reached the highest level since 2014, led by Equitix’s Rakiza Fund I (USD1b), Energy Capital Group’s second fund (UD150m) and Shorooq Partners’ Bedaya Fund II (USD150m).

- Matrix Partners reached a USD1.6b final for its seventh USD-denominated China VC fund in July, the largest disclosed China fund raised thus far in 2023. CNY-denominated funds accounted for 37 of the 48 China funds holding a close in Q1-Q3 2023.

- First-time fund closes in Q3 2023 included Growtheum Capital’s Southeast Asia-focused SEA Fund I (USD567m) and Creaegis Advisors’ India-focused growth fund (USD425m).

- Carlyle’s acquisition of a significant minority stake in Singapore-based engineering solutions provider Quest Global from Bain and Advent for USD500m in Q3 represents the largest disclosed investment in Southeast Asia this year.

GPCA Members can log in to download the Q3 2023 Industry Data & Analysis Excel file, which contains expanded analysis and commentary; fund and transaction listings; and breakdowns of investment activity by asset class, sector and geography.

For questions and feedback or to request custom data cuts from the research team – including GPCA’s complete fund- and deal-level dataset – please contact research@gpcapital.org.