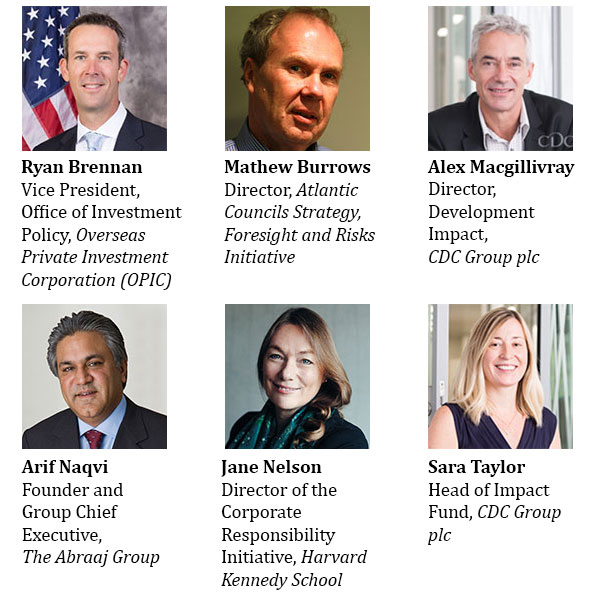

Speakers

About

The United Nations estimates that reaching the Sustainable Development Goals (SDGs) in emerging markets will cost approximately US$3.9 trillion per year, and assumptions based on current investment levels and private sector participa leave an estimated financing gap of US$2.5 trillion annually. Long-term private capital investors are thoughtfully considering the benefits and consequences of their emerging market portfolios, and increasingly focusing on creating value and scalable impact through sustainable business practices. Impact investing has emerged as key to closing the SDG financing gap and the most promising approach to providing financial returns above investor hurdle rates. Fund managers and institutional investors alike are measuring, evaluating and defining their impact across varied axes. As sustainable investment continues to be high on the agenda with data beginning to link impactful outcomes to significant commercial returns, this event brings together key industry stakeholders to address key concerns and share best practices.

Our industry-leading speakers and panellists will draw on personal experience, citing challenges and outlining solutions, including those demonstrated through case studies of recent investments. The agenda also offers the opportunity for attendees to join round table discussions, led by current investors, focussing on impact investment sectors such as healthcare, agriculture, education and energy. The Summit will also look to the future by examining how evolving investor sentiment, driven in part by the rise of the millennial generation and influenced by international agreements such as the Paris Climate Accord and the UN SDGs, will shape investment decisions. Attendees will include investors across the private capital spectrum, including family offices, foundations, endowments, development finance institutions, sovereign wealth funds and fund managers, seeking to better understand the financial/social implications of sustainable and impact investing.

See the full agenda

Sustainability and Operational Excellence Challenge

The EMPEA Institute presents the winner of the second annual Sustainability and Operational Excellence Challenge: Vital Capital was selected for its active management of Luanda Medical Center by securing the most votes from a global audience of over 250 leading emerging market private capital investors convened at the EMPEA and Financial Times’ Sustainable Investing in Emerging Markets leadership summit. The audience members voted for the firm that they believed exemplified the best case study of outstanding sustainable impact from an operational, environmental, social and governance perspective

Sponsors

EMPEA is grateful for the thought leadership and strategic contributions provided by